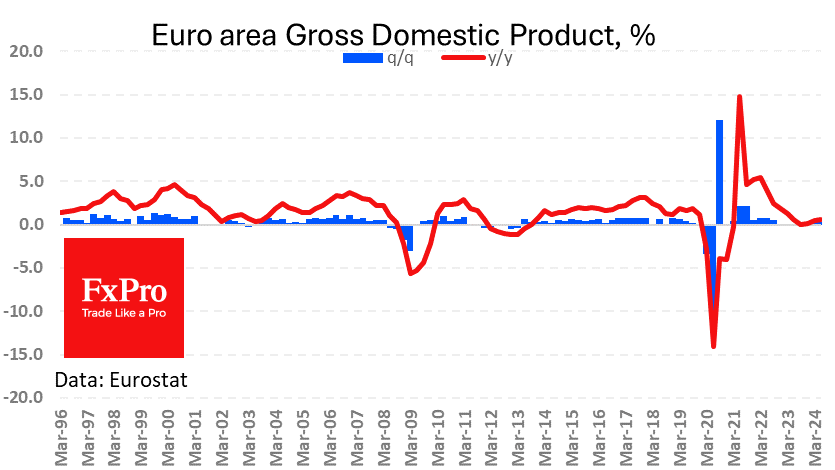

Eurozone GDP grew by 0.3% q/q and 0.6% q/q, showing some acceleration and exceeding average forecasts. This is still a very low pace, but the economy has managed to add in a high interest rate environment, avoiding recession. The situation is not uniform, as while the German economy lost 0.1% q/q and 0.1% y/y on a seasonally adjusted basis, Spain surprised with growth of 0.8% q/q and 2.9% y/y. Indicators for the entire Euro-region are rather weak, not preventing expectations of a rate cut in September from building up.

July inflation estimates were also released today across the euro region. In contrast, Germany beat expectations with a 0.3% m/m and a 2.3% y/y gain. Price growth in Spain slowed from 3.4% to 2.8% y/y, stronger than the 3.0% expected.

A positive data surprise from Germany raises the odds that Wednesday’s euro-region data release will not show a slowdown from June’s 2.5% y/y. Commodity prices have been dipping lately, with the services sector giving the main thrust. So far, ECB officials do not see this as a big problem, although it is weighing on inflation expectations. Commodity prices are quite volatile, and they can be fuelled by a wide range of factors, from geopolitics and broken logistics to positive market response to economic acceleration due to monetary easing.

Contradictory European data poisoned EURUSD to test the round level of 1.08. The 50- and 200-day moving averages are also intertwined near this level. We see this as the markets entering a baseline ahead of Fed rate decisions and labour market data, deferring volatility to these releases. Deviations from expectations have the potential to cause not only increased volatility but also provide trend momentum for a few weeks or months after seven months of barely breaking above 1.07-1.09.

The FxPro Analyst Team