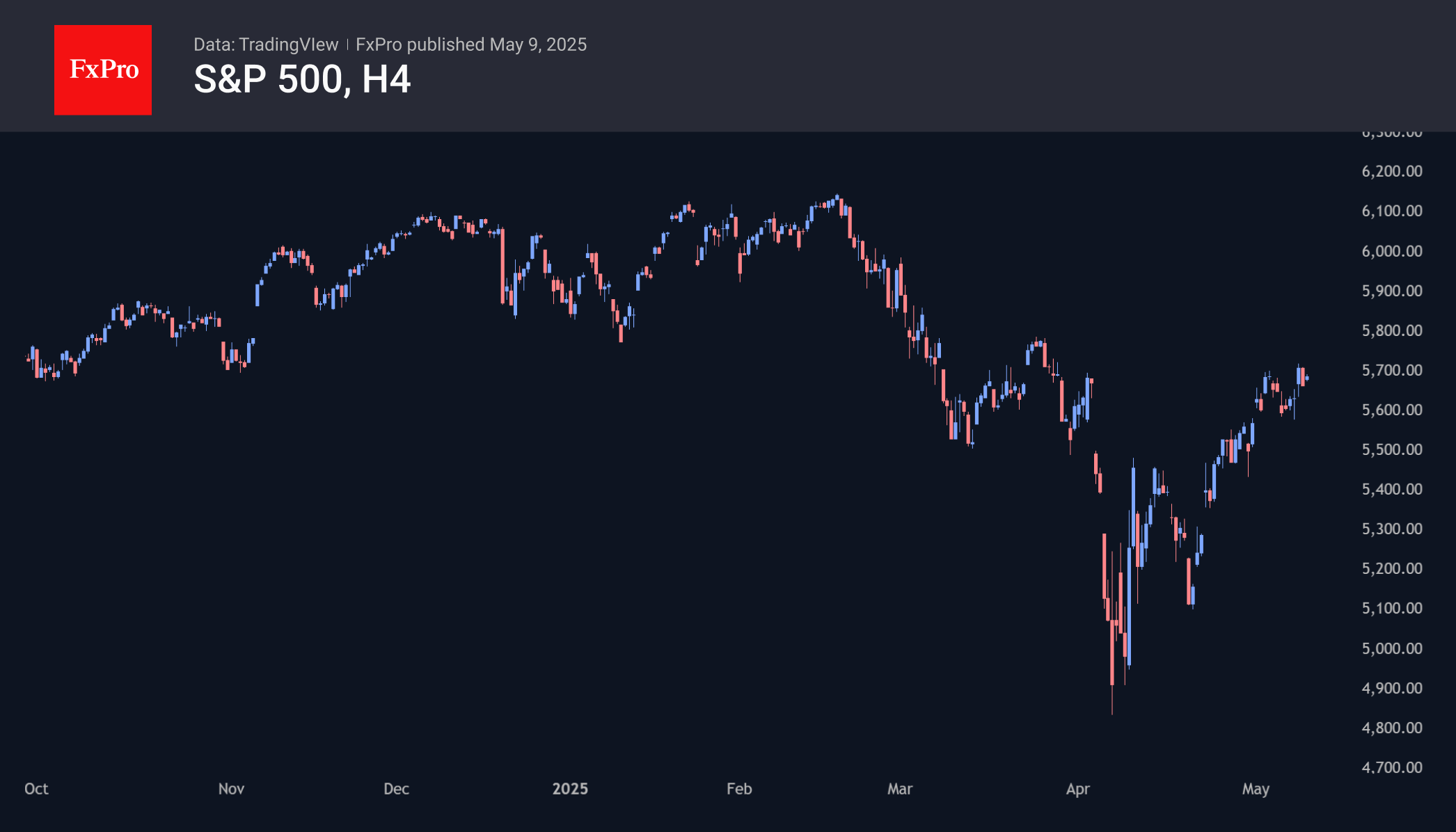

The 13% rally of the S&P 500 from April’s bottom levels made stocks expensive again and increased the likelihood of renewed capital outflows from the US to Europe and other regions. However, Citigroup categorically does not recommend getting rid of US securities.

At the same time, JP Morgan believes that the broad stock index has a better chance of rising towards 6000 than going into a deep correction. They say that the easing of trade tensions, the ‘bullish’ sentiment of individual investors and corporate reports that beat forecasts will allow the S&P 500 to continue its rally.

Whereas the Fed previously helped US and global equities with its rate cuts and balance sheet expansion, the broad stock index now has a different ally. Donald Trump and his team are doing everything they can to convince investors that trade tensions are easing — and that tariffs have peaked and can only go down from here.

This fuels market greed and the desire to join those who have bought back the failure. In such an environment, only a significant deterioration in US macroeconomic statistics will revive fears of recession and put barriers in the way of the S&P 500 heading north.

The FxPro Analyst Team