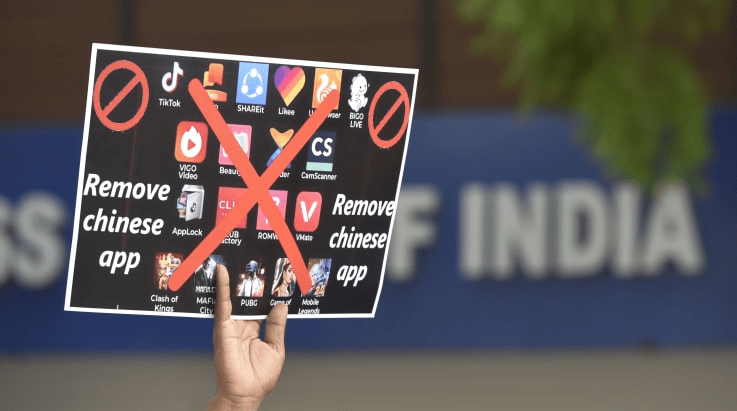

A border clash with China in the Himalayas left 20 Indian soldiers dead and soured public sentiment, with many in India, including some local politicians, calling for a boycott of Chinese products. It exerted pressure on Prime Minister Narendra Modi’s government to respond even as military commanders from both sides engaged in negotiations to alleviate tensions. India banned dozens of Chinese mobile apps last week, which drew Beijing’s ire.

On Monday, Reuters reported that China began pulling back troops from along the contested border, citing Indian government sources. But experts say it is difficult for New Delhi to disengage from Beijing and reduce its ties in the near term because of how intertwined the countries have become in recent decades.

Data shows China’s influence in trade, investments and technology in India has grown substantially over the years. India has an asymmetric trade relationship with China, its largest trading partner after the United States.

Government data showed India imported more than $65 billion worth of goods from China between April 2019 and March this year and exported only around $16.6 billion worth of products. That left New Delhi with a more than $48 billion trade deficit with Beijing. Still, trade volume is down from the previous fiscal year that ended in March 2019 while reports suggest India is planning additional duties on certain Chinese imports.

Chinese investments into Indian companies have steadily grown in recent years, data showed. Between 2015 and last month, there were 42 deals worth $8.7 billion announced where the investor was a Chinese firm and the target company was based in India, according to information provided to CNBC by Mergermarket. Each deal had a value of more than $5 million, according to Mergermarket.

Chinese investors have put an estimated $4 billion into Indian start-ups, according to a report from foreign policy think tank Gateway House earlier this year. As of March, 18 of India’s 30 unicorns — start-ups valued over $1 billion — have received funding from Chinese investors.

India already introduced restrictive measures on Chinese foreign direct investments before last month’s border clash. Reuters reported that the Indian government is reviewing around 50 investment proposals involving Chinese companies under those measures. Restrictions on investments from China might potentially hamstring India’s start-ups in the near term as they will have to look elsewhere to raise fresh funds.

Three reasons India can’t quickly distance itself from China despite the border clash, CNBC, Jul 7