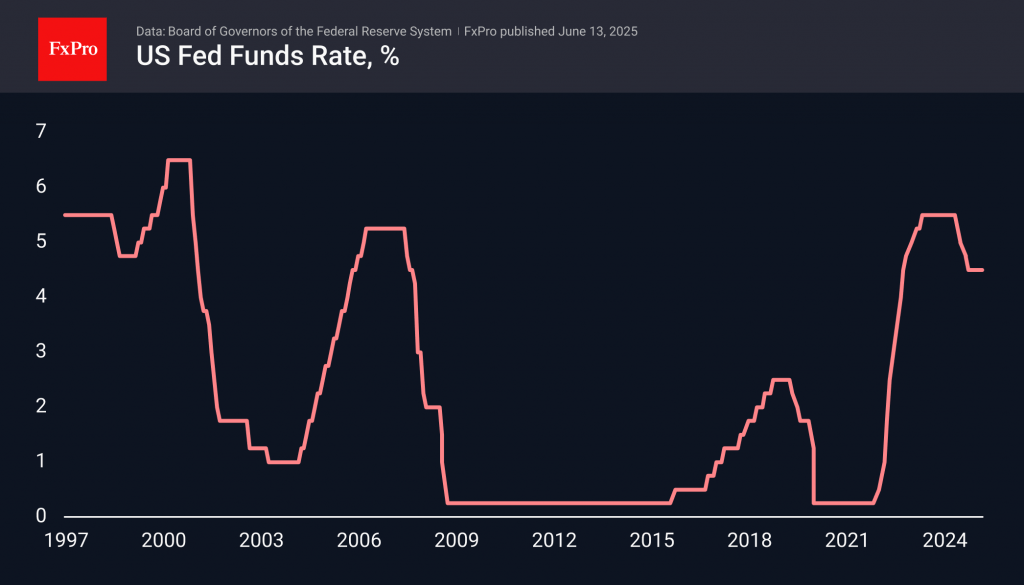

Central banks will dominate the third week of June. The central event will be the Fed meeting. The futures market does not expect a monetary easing. However, the focus will be on an updated FOMC forecast, including the Fed Funds Rate and inflation/growth expectations. Derivatives predict that it will fall by 50 basis points by the end of 2025. If Fed officials see a different figure or try to guide expectations somewhere, the prospects for dollar pairs on Forex will be reassessed.

Investors do not expect monetary policy adjustments in Japan and England. Only the Swiss National Bank is likely to lower borrowing costs and hint at continuing the cycle in September. Rates are at risk of falling below zero by the end of the year.

The Bank of Japan intends to announce a reduction in bond purchases under QE. It is under pressure from the White House. The US Treasury is calling on Kazuo Ueda to raise rates. The regulator’s hawkish rhetoric will strengthen the yen.

Investors will be watching US retail sales statistics, which will clarify the outlook for domestic demand and the economy. Negative data could fuel rumours of a recession. This would be a blow to both stock indices and the US dollar.

The FxPro Analyst Team