Clarification of the tariff situation allows markets to restore old ties and turn their attention to economic events. Yes, investors remain concerned about the potential US–EU trade agreement ahead of the August 1st deadline and ongoing negotiations between Washington and Beijing. However, the focus will shift to the packed economic calendar, which will take centre stage.

The releases of US GDP data for the second quarter and labour market data for July will be the highlights of the week, as will the FOMC meeting. Bloomberg experts do not expect a cut in the federal funds rate, but there may be two dissenters in the Fed. Christopher Waller and Michelle Bowman have made it clear that they are not opposed to an immediate rate cut.

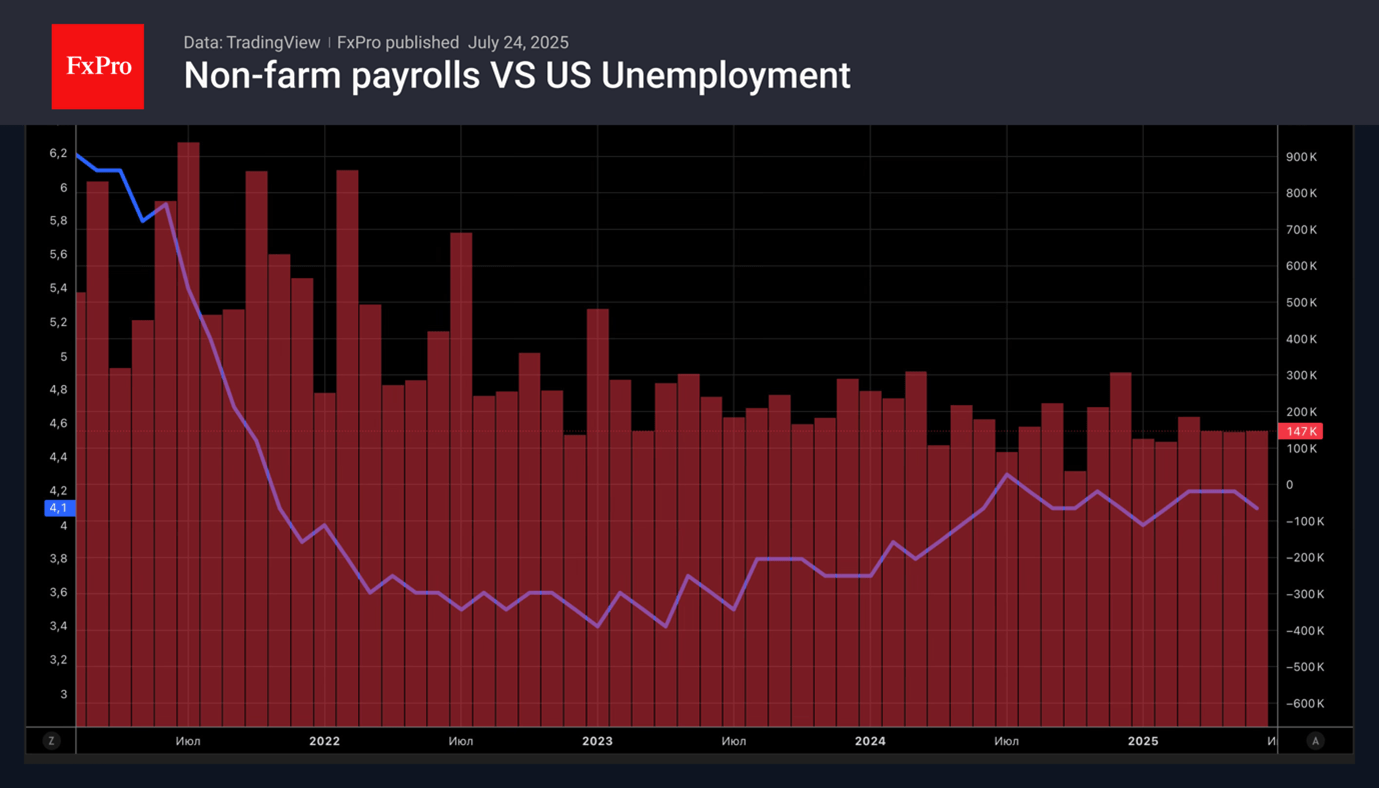

After GDP fell into negative territory in the first quarter, Trading Economics expects the indicator to grow by 2.5% in the second quarter thanks to a recovery in net exports. It seems that the US economy is not going to fall off a cliff. However, slowing employment and rising unemployment could be warning signs of a slowdown. As a result, stock indices and the dollar are at risk of going on a roller coaster ride.

The FxPro Analyst Team