The following publications could cause some interesting movements in global markets this week.

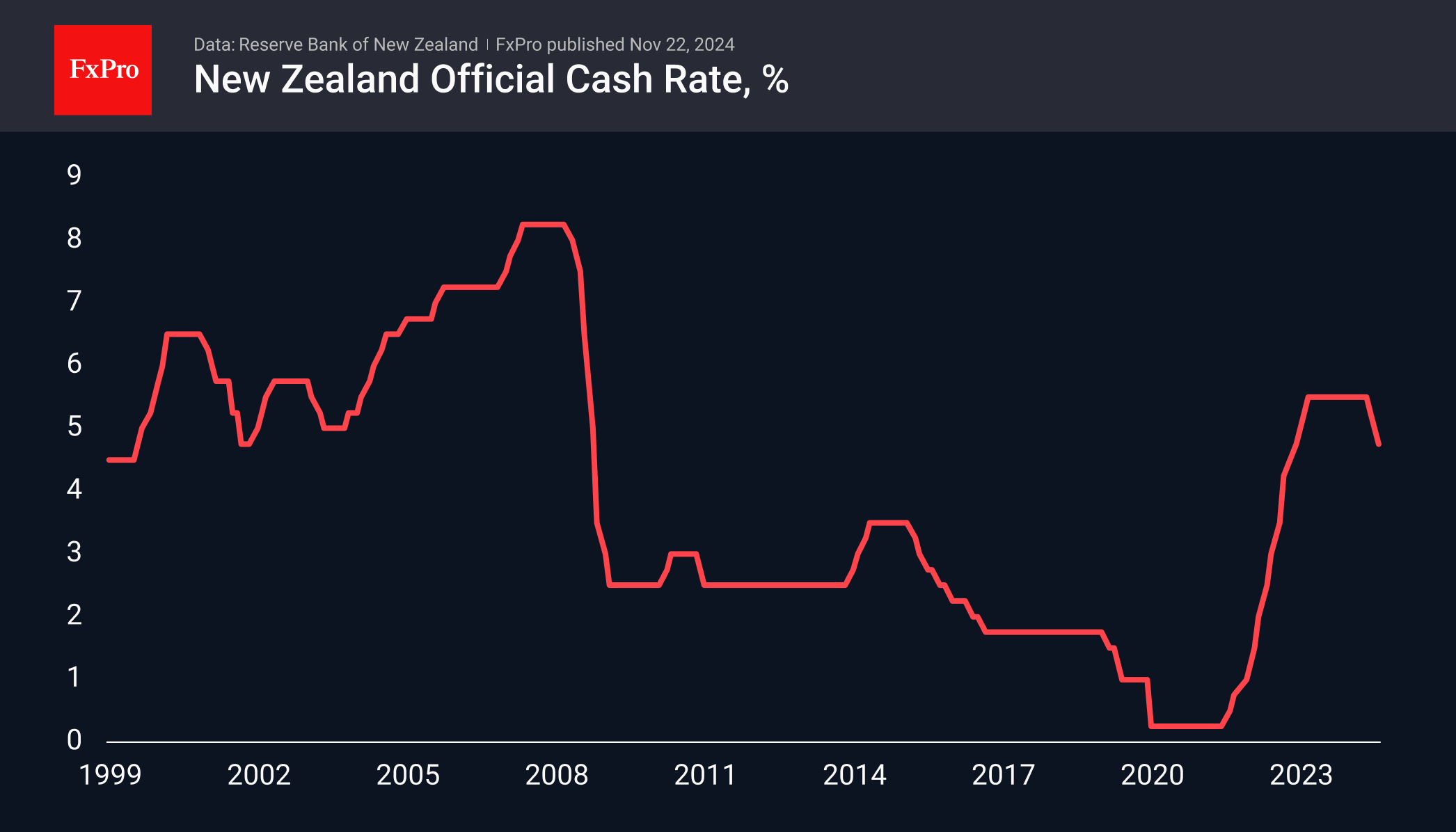

At the very start of the day on Wednesday, the Reserve Bank of New Zealand will release its interest rate decision. In August, it was cut by 25 points against most expectations, and in October, it was cut by 50 points in one go. Now, the prevailing forecast is for the rate to remain unchanged at 4.75% after a double move at the last meeting. This meeting is important for the Kiwi, which is trading near the lower end of this year’s range. A dovish tone from the central bank could trigger a dam-busting effect, sending the currency towards the 2022 and 2020 lows near 0.55.

On Wednesday evening, the Fed will release the minutes of its latest meeting, which could help clarify the US central bank’s view on the outlook for monetary policy after two rate cuts. Are they really close to pausing after two cuts totalling 75 basis points?

At the end of the week, the focus shifts to inflation in Europe, with the release of preliminary German inflation estimates on Thursday and all eyes on the Eurozone composite figures on Friday. In Germany, the rate of price increases has stabilised just above the ECB’s 2% target since March. But the acceleration from 1.6% in September to 2.0% in October is attracting attention. Will November confirm the emergence of a new growth trend?

Overall eurozone inflation also reached 2% in October, and all eyes will be on its future direction. Eurozone figures can determine the ECB’s sentiment, which in turn affects the EUR exchange rate, which is at a technically important level.

The FxPro Analyst Team