The following publications could cause some interesting movements in global markets this week.

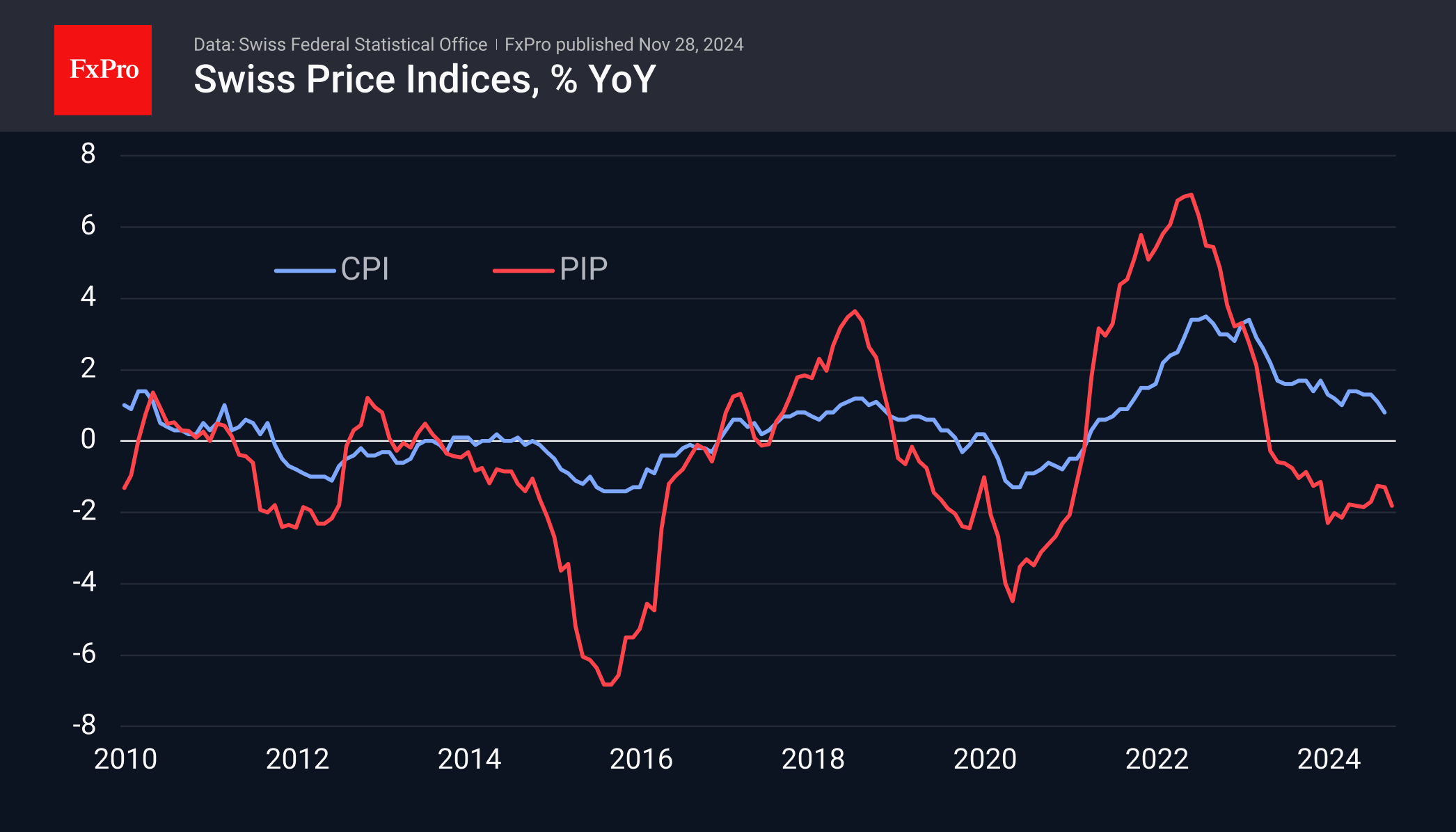

On Tuesday, Switzerland will publish its consumer price index. Here, annual inflation has slowed to just 0.6%. The Swiss National Bank is aiming for an inflation range of zero to 2%. A further slowdown in the CPI sets the stage for additional monetary easing. Some observers were recently surprised that the head of the SNB is allowing negative interest rates in the future. The policy rate is now at 1% and may be cut further on the 12th of December. The latest inflation data will determine whether the move will be 25 or 50 points.

Much of the focus in the new week will be on Friday’s US employment data. October was very problematic due to one-off factors, such as strikes and a hurricane. As a result, the economy only added 12,000 jobs. All eyes will be on whether the labour market will post a double-digit gain or maintain its growth rate. Strong data is positive for the dollar but could also support equities.

Canada will release its employment figures at the same time as the US. Unemployment has risen from 5.7% to 6.5% since the beginning of the year despite a decline in the labour force participation rate.