The U.S. dollar is at risk of falling below the lower end of a 12-year trendline as some analysts argue that this may be a bullish turning point for Bitcoin’s price.

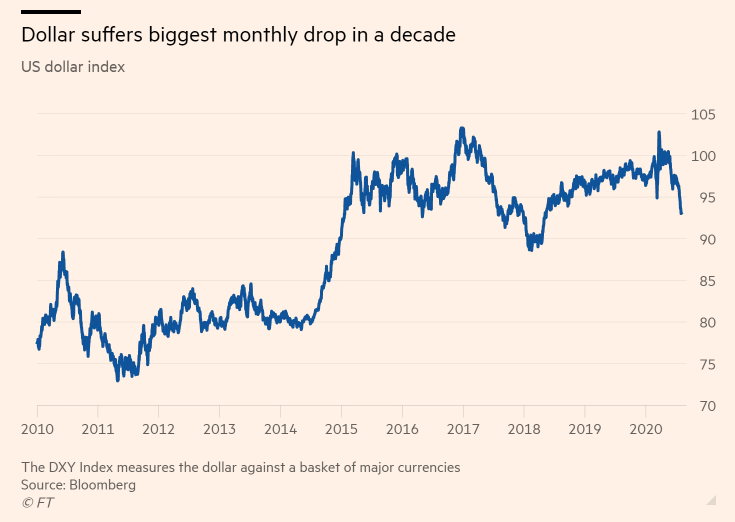

The United States dollar index is currently testing the bottom of a 12-year trendline. But some traders are calling it the “most pivotal moment” for the global reserve currency since 2008, as they believe that continuous depreciation will likely boost the price of Bitcoin (BTC). For over three months since April, the dollar has declined against other reserve currencies. Some investors believe that the fall in the value of the dollar has affected the price of Bitcoin. Prominent cryptocurrency trader Scott Melker said:

The value of the dollar affects Bitcoin because traders typically price BTC against it. When the dollar depreciates, the asset that BTC is trading against is lower in value. Hence, when the dollar drops, it might increase the likelihood of BTC upside. Hao said:

“If the dollar continues to depreciate, there is a high probability that Bitcoin will continue to rise.” Mark Wilcox, a Bitcoin analyst, raised a similar point. He pinpointed the biggest monthly drop of the dollar as the driving factor of BTC in the past several months. Wilcox explained that rather than Bitcoin increasing in value, it is the dollar that actually declined in price. He said, “bitcoin didn’t go up, the dollar went down,” referring to the U.S. dollar index.

Analysts say the dollar has been declining relative to other reserve currencies due to the slowing U.S. economy. The U.S. has the highest number of coronavirus cases, which is causing the rate of economic growth to slow down.

Higher chances of a BTC uptrend

Traders are seemingly cautiously optimistic about the near-term trend of Bitcoin. At the same time, Bitcoin trading activity is reaching new highs in various markets, including institutional venues such as the CME and its BTC futures contracts.

In recent weeks, the open interest of the CME Bitcoin futures market has risen to an all-time high. It indicates higher activity from accredited and institutional investors. The rising appetite for BTC coincides with a falling dollar, which could further improve the sentiment around Bitcoin.

‘High Probability’ Bitcoin Rises as USD Sinks to 2008 Levels, Says CEO, CoinTelegraph, Aug 4