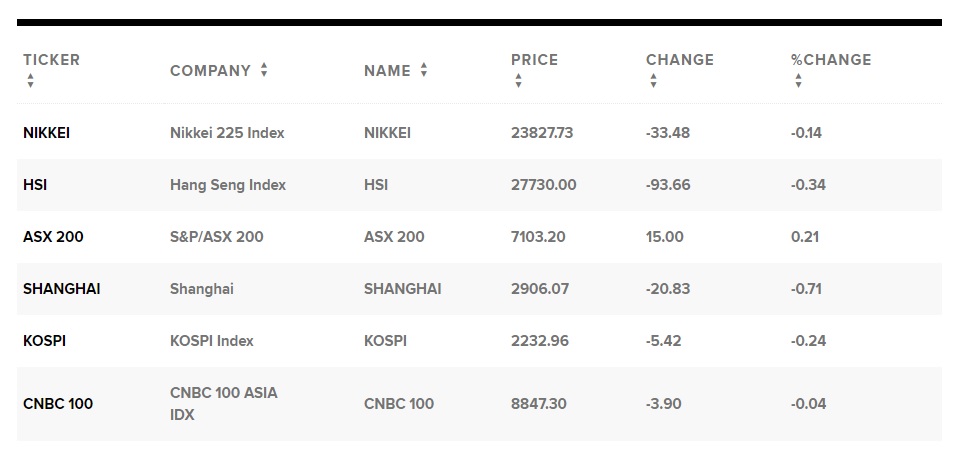

Stocks in major Asian markets declined on Thursday as investors weighed a spike in the number of new coronavirus cases reported in China’s Hubei province due to a tweak in methodology. Mainland Chinese stocks reversed earlier gains and ended their trading day lower, with the Shanghai composite down 0.71% to about 2,906.07 and the Shenzhen component declining 0.7% to 10,864.32 while the Shenzhen composite fell 0.769% to around 1,771.61. Hong Kong’s Hang Seng index was 0.29% lower, as of its final hour of trading.

China’s Hubei province on Thursday reported a spike in the number of new coronavirus cases. It said it started to include “clinically diagnosed” cases in its tally. In Japan, the Nikkei 225 fell 0.14% to close at 23,827.73 while the Topix index finished its trading day 0.34% lower at 1,713.08. Shares of conglomerate Softbank Group declined after Wednesday’s blockbuster surge, falling 5.09% on the day, with the moves on Thursday coming after the firm posted a near wipe out of its quarterly profit.

Meanwhile, South Korea’s Kospi slipped 0.24% to finish its trading day at 2,232.96 as shares of automaker Hyundai Motor dropped 2.21%. Stocks in Australia closed in positive territory, with the S&P/ASX 200 up 0.21% to 7,103.20. Overall, the MSCI Asia ex-Japan index was 0.17% lower. Market sentiment had been been positive earlier in the week as the data had been showing an apparent slowdown in the pace of new reported cases, with policymakers in China having announced a series of measures to combat the expected economic slowdown from the virus outbreak.