Oil prices are up more than 7.5% so far today, bringing Brent close to $101 a barrel. Futures for gas, which is traded in the US, add more than 5% on a sharp aggravation of the situation around Ukraine. Putin officially announced the start of a “military operation,” which the Ukrainian authorities called a full-scale invasion.

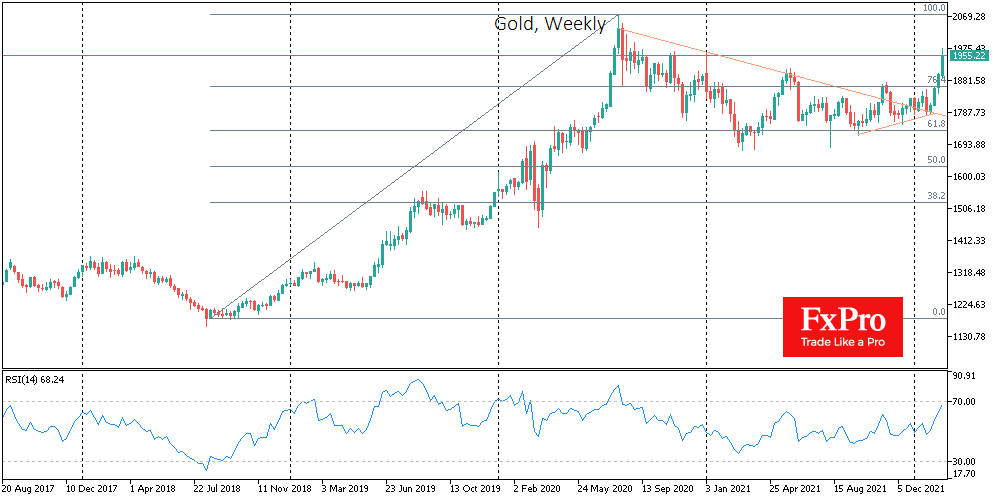

The price of a troy ounce of gold was approaching $1,975, reaching its highest point since September 2020, on a massive flee into defensive assets.

European indices are under selling pressure, with the DAX 40 and Euro Stoxx 50 losing about 4%, hitting their lows since March 2021. The FTSE100 index is down about 3%, the same amount is lost by the Nasdaq100 futures, while the Dow Jones 30 and S&P500 are down by 2.5%.

Market drivers are no longer macroeconomics but private messages from the military and local residents. Under such conditions, stock and commodity price valuations almost lose their meaning. Ukraine and Russia are major exporters of agricultural products and metals, which also promises to push prices up until the situation becomes more stable, which is unlikely to happen in the coming days.

Even in the event of a suspension of the military operation, one should prepare for prolonged interruptions in the supply of energy, metals and food, which will destabilize the prices of these goods. Right now, extreme volatility in global markets (outside of Russia and Ukraine) cannot yet be stated.

Still, the situation is evolving, risking shockwaves in commodity and energy prices in the coming days. The potential of gold as a defensive asset is also far from being discovered.

The FxPro Analyst Team