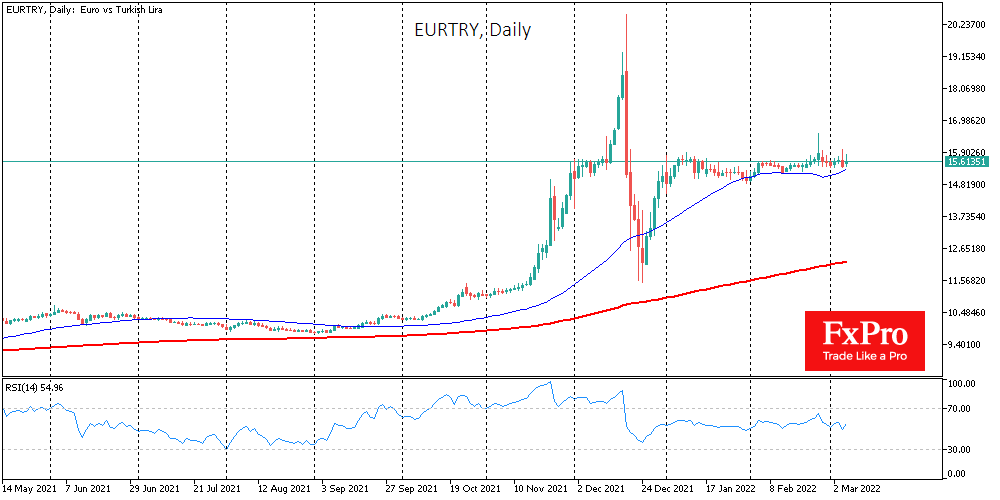

Since the beginning of the year, the Turkish lira has looked like a safe haven, trading in a very tight range against the euro. However, recent events make us look at the economic prospects of this currency with concern.

In Russia and Ukraine, Turkey bought up to 70% of all crop imports in past years. Exchange prices for these goods entered the area of historical highs, where they were for a short time in 2011 or 2008. In general, the food basket updates historical records with a large margin both in nominal and real terms.

Oil and gas, significant components of Turkey’s imports, are also rapidly rising in price. Turkey imports all the natural gas it consumes. An impressive share falls on long-term contracts and therefore is protected from the latest price surge. At the same time, long-term records will inevitably increase the cost of imports.

Rising energy and food prices hit the poorest segments of the population, multiplying the negative effect of the lira’s devaluation last year.

Even worse, the economic collapse of Ukraine and Russia in the light of recent events will practically deprive Turkey of tourists from these countries, further increasing financial pressure.

Among third countries, Turkey appears to be the most interested in ending the conflict and normalizing market conditions. Therefore, it is not surprising that the Turkish authorities insistently offer to stop the hostilities.

The FxPro Analyst Team