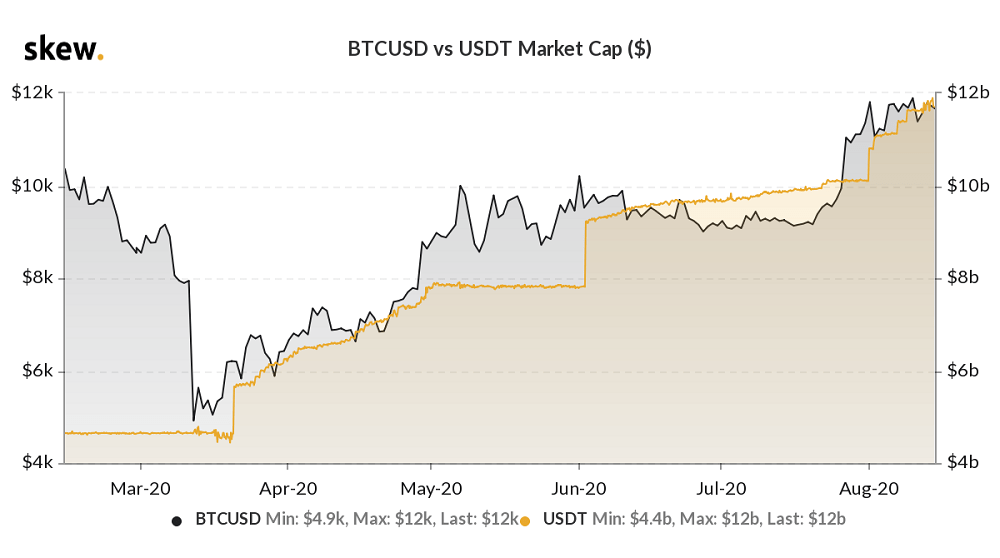

The market capitalization of Tether (USDT) surpassed $12 billion as of Aug. 14, according to cryptocurrency market analytics firm Coinmetrics. Meanwhile, some believe the rapidly-rising valuation of the dominant stablecoin positively benefits Bitcoin (BTC) in the long term. But some investors also fear that it makes the cryptocurrency market vulnerable.

Tether has been the most widely-utilized stablecoin for several years, and it has seen exponential growth. In January 2017, the total supply of Tether was hovering at around $10 million. Within four years, that number has increased by 1,200-fold.

Tether is used as a substitute for fiat currencies across major exchanges, including Binance and Bitfinex. As such, cryptocurrency investors often rely on Tether to store capital on the sidelines.

Coinmetrics researchers explain:

“Moving into stablecoins allows investors to effectively keep money parked on the sideline without having to completely cash out into fiat currency and incurring fees. This rush to safety likely accounted for a significant portion of the increased stablecoin demand following March 12th.”

Since Tether is often used to hedge against major cryptocurrencies, an argument could be made that its supply represents capital waiting on the sidelines. When the supply of Tether expands, it might indicate that investors are actively hedging, leaving an abundant supply of capital ready to enter the crypto market.

‘How Can You Be Bearish?’ Asks Bitcoin Trader as Tether Surpasses $12B, CoinTelegraph, Aug 14