Four months ago, Abolaji Odunjo made a fundamental change to his business selling mobile phones in a bustling street market in Lagos: He started paying his suppliers in bitcoin. Odunjo sources handsets and accessories from China and the United Arab Emirates. His Chinese suppliers asked to be paid in the cryptocurrency, he said, for speed and convenience. The shift has boosted his profits, as he no longer has to buy dollars using the Nigerian naira or shell out fees to money-transfer firms. It is also one example of how, in Africa, bitcoin – the original and biggest cryptocurrency – is finding the practical use that it has largely failed to elsewhere.

“Bitcoin helped to protect my business against the currency devaluation, and enabled me to grow at the same time,” Odunjo told Reuters from his two-by-eight metre shop. “You don’t have to pay charges, you don’t have to buy dollars,” the 30-year-old said, raising his voice above the sound of loud haggling and the honking horns of scooters.

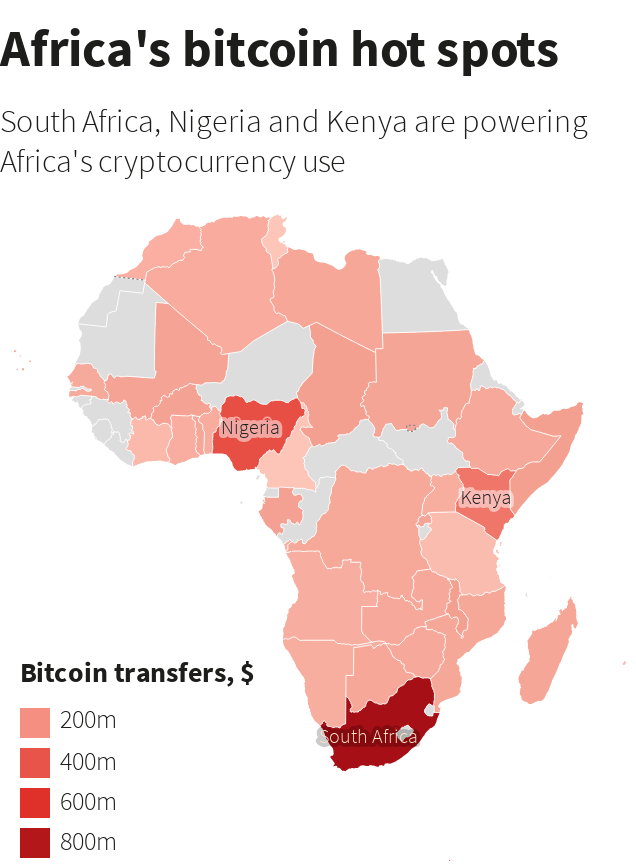

Monthly cryptocurrency transfers to and from Africa of under $10,000 – typically made by individuals and small businesses – jumped more than 55% in a year to reach $316 million in June, the data from U.S. blockchain research firm Chainalysis shows. The number of monthly transfers also rose by almost half, surpassing 600,700, according to Chainalysis, which says the research is the most comprehensive effort yet to map out global crypto use. Much of the activity took place in Nigeria, the continent’s biggest economy, along with South Africa and Kenya.

This represents a reversal for bitcoin which, despite its birth as a payments tool over a decade ago, has mainly been used for speculation by financial traders rather than for commerce. Why a boom in Africa? Young, tech-savvy populations that have adapted quickly to bitcoin; weaker local currencies that make it harder to get dollars, the de facto currency of global trade; and complex bureaucracy that complicates money transfers. In 2018, the Nigerian central bank warned cryptocurrencies were not legal tender, and investors were unprotected.

How bitcoin met the real world in Africa, Reuters, Sep 8