The housing market is in trouble after the Trump administration reaffirmed it is moving away from stimulus talks until post-election. While Trump seemed to flip-flop on the idea Wednesday morning, the president is open to signing a slimmed-down stimulus bill in the near term.

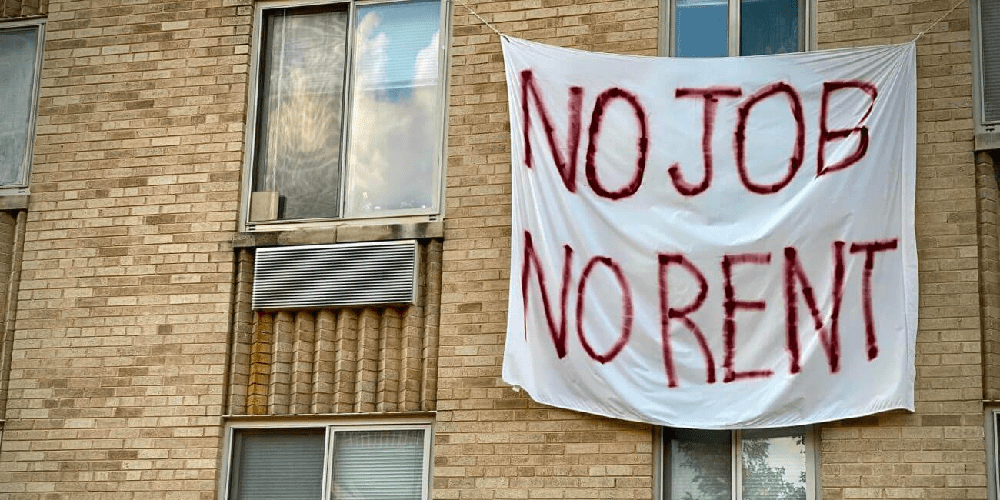

Strategists see an impending pandemic-induced stock market crash, but commercial real estate and residential housing have enormous capitulation risks. In the short term, the CDC’s national eviction moratorium could prevent a housing crisis. But entering 2021, landlords risk a sharp increase in renters unable to make rent payments.

Initially, the housing market expected a fundamental boost to the housing market. Aid to small businesses and direct stimulus checks would allow business owners and renters to pay rent through October. The unexpected delay of a new round of stimulus has put massive pressure on properties. Consequently, the housing market could soon face a sharp increase in renters struggling to pay rent.

UBS Global Wealth Management conducted a study of 25 major cities and their housing prices. The study found that out of the 25 cities, over 50% are at risk of facing a housing market bubble. In a note obtained by CNBC, UBS researchers wrote: Struggling renters and tenants, combined with a potential correction in home values, could weigh heavily on the housing market. Other “hard” assets alongside real estate, such as gold, have also struggled in the past week.

Stimulus-Induced Stock Crash? No, Housing Market Faces Real Freefall, CCN, Oct 8