Fund managers are trimming exposure to Russia and Ukraine on fears that years of tensions could finally erupt into outright war, bringing economic ruin for Ukraine and more sanctions on Russia. But with largest build up of Russian troops on the Ukrainian border since Moscow’s annexation of Crimea in 2014, and uncompromising rhetoric from the Kremlin, some investors feel market positioning is still not cautious enough.

“People are very sanguine,” said Tim Ash, senior EM sovereign strategist at BlueBay Asset Management. “I’ve covered Ukraine for 33 years, including 2014, and it looks pretty serious. I’m surprised the market reaction is not perhaps a bit more aggressive really.”

Concerns about an escalation, including the immediate threat of sanctions, were partly assuaged after a phone call on Tuesday between U.S. President Joe Biden and his Russian counterpart Vladimir Putin in which Biden proposed a summit meeting between the pair and stressed U.S. commitment to Ukraine’s territorial integrity. The Kremlin said it would study Biden’s proposal. Aberdeen Standard Investments, with around $640 billion in assets under management, reduced some rouble exposure before the latest escalation, but remains exposed to Russia and Ukraine bonds.

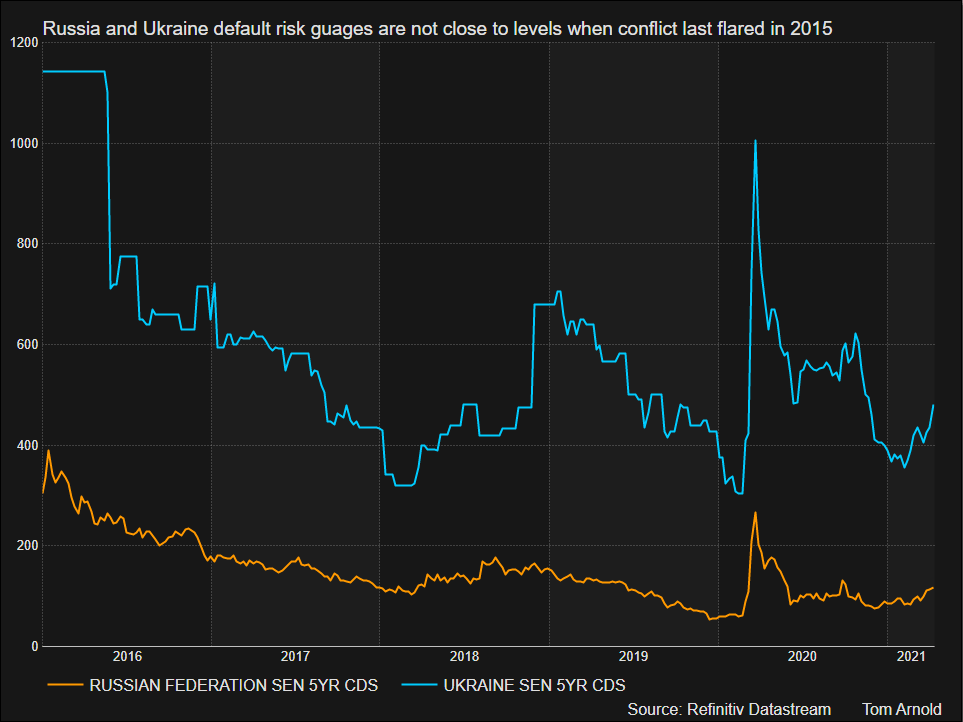

Russia’s rouble on Wednesday scaled two week highs, while dollar-denominated sovereign bonds recovered from a near 12-month trough as investors bet Tuesday’s phone call might keep sanctions off the table for now. Ukraine’s international bonds and GDP warrants, which hand investors a payment if economic growth surpasses certain thresholds, also rallied to two week highs after languishing near five-month lows. The cost of insuring the pair’s sovereign debt, as measured by five-year credit default swaps, are a long way off the highs of early 2015, the last time serious fighting flared between the two nations.

Analysis: Hot or cold war? Investors try to second guess Russia’s military manoeuvres, Reuters, Apr 15