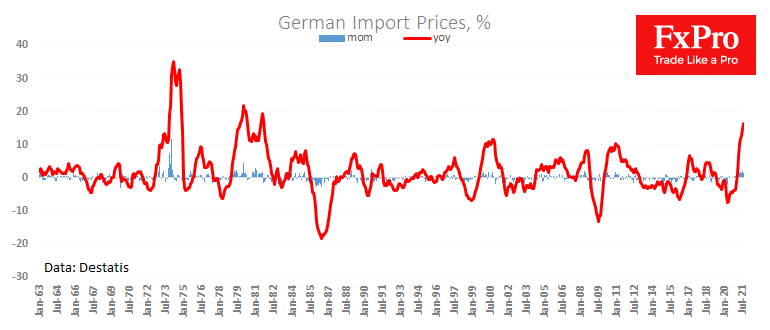

Inflation in the eurozone remains the highest threat. The annual growth rate of import prices in Germany reached a 40-year high of 16.5% y/y. The monthly price increase was 1.4%, lower than the year-to-date average (1.7%) but nine times higher than the historical average since 1962.

A separate release of preliminary Spanish CPI data for September also marked a sharp acceleration from 3.3% to 4%.

The ECB has worked extremely effectively in recent weeks, convincing markets that it will not rush to roll back QE and that it has more time than the Fed. Such rhetoric has led to a market reaction that, instead of the usual response of rising inflation pushing up the currency, rising prices are increasing outflows from the currency.

This is reminiscent of markets’ reaction in emerging countries, where investors perceive high inflation as a threat to the national currency’s purchasing power, directing all eyes to the ECB’s rhetoric.

The FxPro Analyst Team