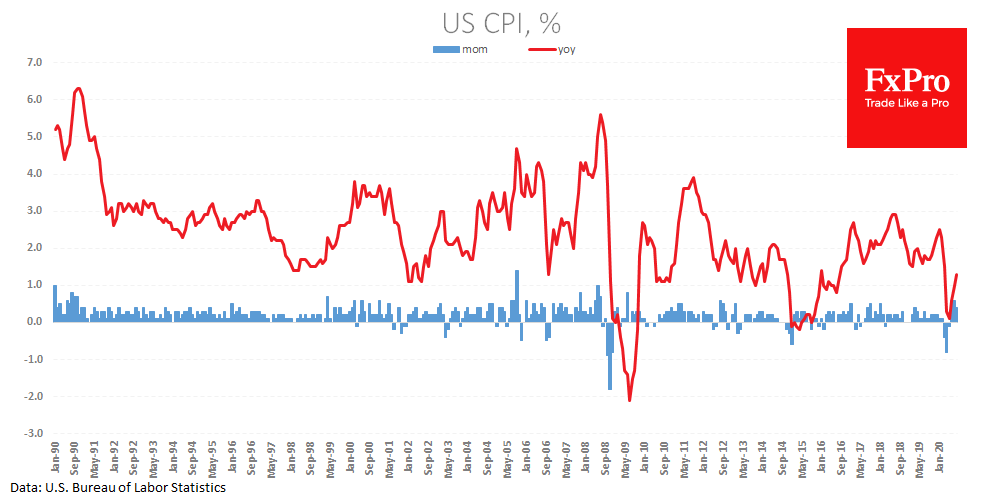

Consumer price growth in the US has exceeded economists’ expectations for the third consecutive month. Published figures for August showed a 0.4% increase after two months of a 0.6% rise. Annual growth accelerated to 1.3%, the highest since March, although it was as low as 0.1% in May.

The Core-CPI index is also gaining, recording an annual growth rate of 1.7% last month.

Last month’s rise in prices was broad, and not based on individual groups. Rapid recovery in inflation usually plays into the hands of the national currency as it reflects strong consumer demand and brings the CB closer to monetary policy tightening. The market seems to have responded to the news based on this logic by strengthening demand for the Dollar.

However, there are some reasonable doubts about the sustainability of dollar growth on such news. A change in the Fed’s strategy has been taken off the agenda for raising rates in the foreseeable future, perhaps up until 2023.

The FxPro Analyst Team