UK inflation data came in slightly higher than expected, helping the Pound to perform better than other European currencies on Wednesday.

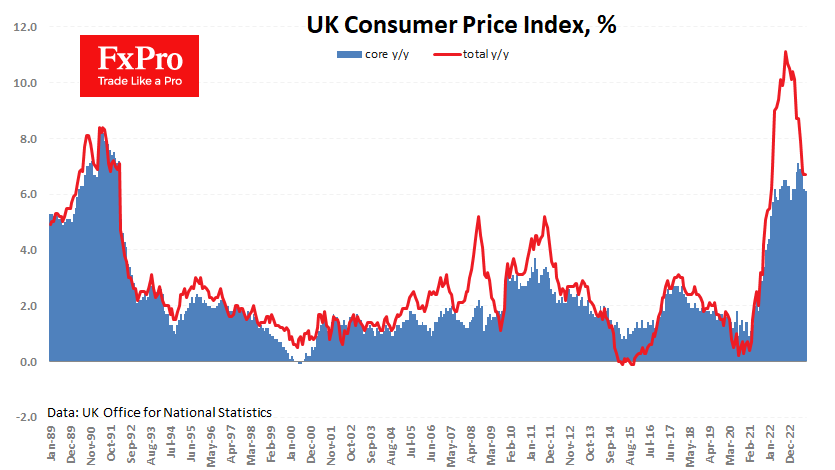

Headline inflation was 6.7% y/y in September, the same as the previous month and 6.8% in July. So we have seen a stabilisation at a very high level in the third quarter, rather than a slowdown.

At the same time, producer prices (PPI) are lower than a year ago. The Input PPI is 2.6% lower than a year ago and has been negative for the past four months. Output PPI is down by 0.1% year-on-year and is only in slightly negative territory for the third month.

Final prices are in no hurry to fall and even slow meaningfully. This report should be another reason for the Bank of England to reconsider. It may still have to raise interest rates to fight inflation, or it may have to keep them high for much longer.

We believe the fight against inflation is now entering its most morally challenging phase. Several signs of a slowing economy have led officials to believe that inflation is on the path they want. But a tight labour market, a new spike in fuel prices and entrenched inflation expectations make the task more difficult. Likely, central bankers will still have to temporarily sacrifice the economy by suppressing demand to tame inflation.

The FxPro Analyst Team