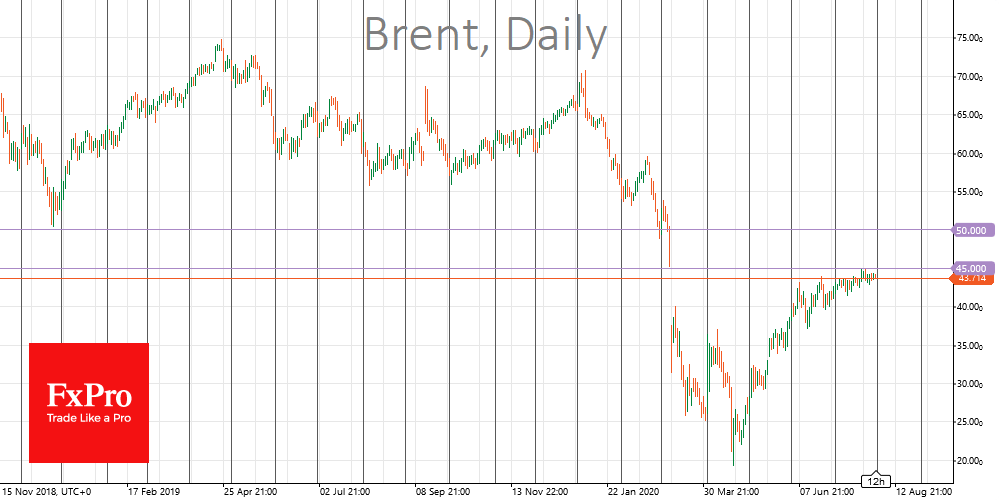

The price of Crude Oil keeps slipping, despite the recent weakening of the dollar. This is an unusual situation, and it seems like bad news for Oil. Currently ignoring the positive attitude, Brent and WTI may receive a powerful blow if the markets return to a wary mood.

Often, Oil grows several times stronger than the weakening of the American currency. For example, from 2000 to 2008, the dollar index lost 30%, while the price of Brent grew 5.5 times.

Now, Oil cannot be called oversold, as it seemed to be March-May. Vast petroleum reserves accumulated during the lockdown in many countries, hindering its growth. Although the rate of reserves creation is no longer so frightening, their amounts are still putting pressure on prices.

The latest weekly data showed a decline in crude oil reserves in the USA by 10.6M barrels. However, the decline in reserves is the norm for this time of the year. Crude Oil in private stocks is 20.5% higher than a year ago (+20.6% a week earlier).

The total number of drilling rigs in operation has been decreasing weekly since March. However, last week, the data showed the first increase in the number of oil rigs. This may be the first signal that U.S. production companies have faith in the demand for their Oil and believe the current or forecast prices are sufficient to return to production growth.

U.S. Crude supply is about the same as a year ago, at 11.1M barrels per day. In countries adhering to the OPEC+ agreement, production is more than 10% below last years levels, while Saudi Arabia and Russia temporarily cut their output by more than 20% from the peaks of March.

However, they are set to bring capacity back into operation as demand gradually recovers. On the one hand, quotes will be pressed by the vital need for OPEC+ countries to restore production as quickly as possible to raise budget revenues. As of next week, the cartel and allies will increase production quotas.

An additional unknown is the dynamics of consumption, which is affected by threats of new restrictions on movement due to the increasing number of new coronavirus victims. This further aggravates the prospects for recovery in the industry and risks turning into a new round of price reductions in the coming days or weeks.

The FxPro Analyst Team