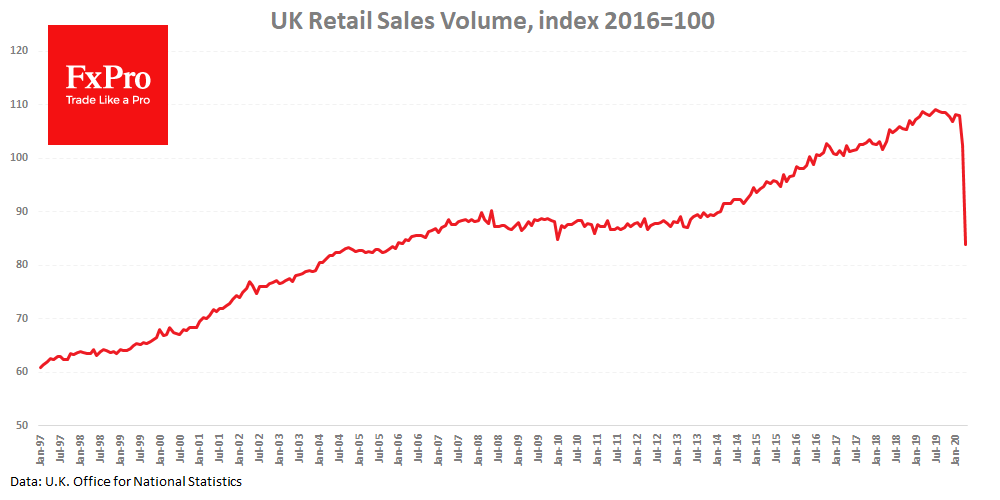

The British pound is falling for the third day in a row to 1.2160 earlier today, receiving a new impulse of pressure after the release of alarming statistics. Retail sales fell 18.1% in April (by 15.2% ex-fuel), slightly weaker than expected. It is unnecessary to say that it was the record collapse in the history of the indicator. The retail sales index fell to 2005 levels.

Also, ONS reported an increase in the budget deficit significantly higher than forecasted amid a 26% revenue drop and a 54% surge in spending. As a result, net public debt reached 97.7% of GDP and, 113.4% including debt of public sector banks, reached its highest level over the past six years.

Right now, borrowing is not a problem for the UK Treasury as government bond yields have fallen to record lows. Earlier this week, the Treasury first borrowed from markets at a negative rate. However, in the longer term, the combination of low inflation, a weak economy and a high debt burden reduces the potential for GDP growth. Reinhart and Rogoff in the book “This time is different” noted that the growth rate of the economy is sharply slowing at a public debt close to 100% of GDP. A recent example of Europe and Britain showed why: at the earliest opportunity, the government switches from stimulating growth to fiscal discipline.

The FxPro Analyst Team