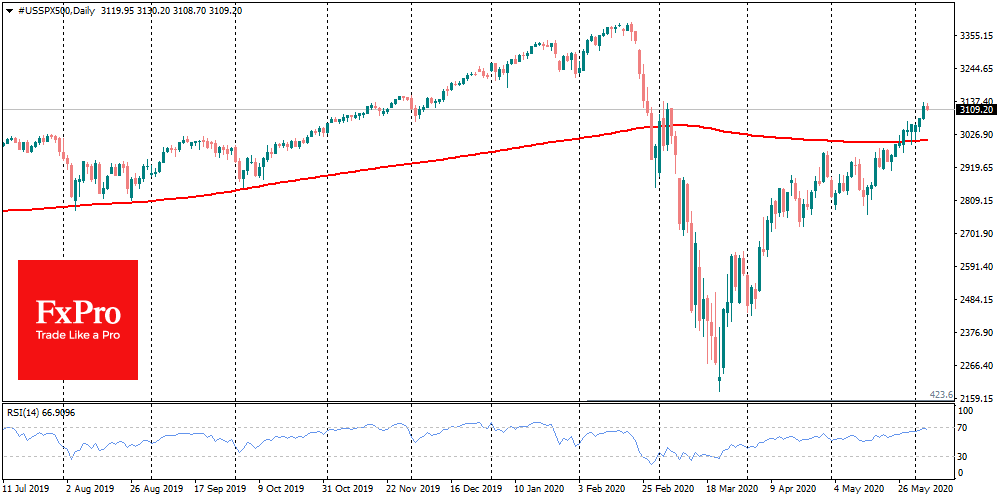

On Thursday morning, markets paused the impressive growth of stock indices the day before. The S&P 500 added 1.4% to 3115, which is in line with March’s high and only 7.8% below its historical highs. The German DAX was 10% below its peak, showing a 4% rally on Wednesday amid a new stimulus package of €120bn and defeating the 200-day average.

The difference between expectations and facts drives markets. Recently, market participants’ expectations look very optimistic, which increases the fragility of growth. Firstly, stock buyers are impressed by relatively strong employment in Europe and the US. But it continues to decline at a pace that exceeds the worst moments of the global financial crisis, despite the lifting of restrictions.

Besides, the unemployment rate in Europe is actually lower than reported due to the statistical features of the calculations. For example, in Italy, the unemployment rate in April fell (!) from 8.0% to 6.3%, only to since drop 745k out of the labour force. Similarly forced contraction of the labour market, in general, is taking place in other European countries, even if not in such a pronounced form.

In Europe, market participants are preparing for more support from the ECB later today. These plans for the easing of the central bank’s policy, as well as massive and rapid programs to help businesses in Europe, are already virtually priced in the stock index quotations. However, Europe has repeatedly delayed the launch of plans due to internal disagreements and bureaucracy. The support was accelerated only by the miserable situation in the markets, which is not now the case. Rapid growth is likely to give politicians time for reflections and discussions.

Often, the currency market is alarmed a little bit earlier than the stock market. And in the morning we are witnessing the dollar strengthening against a wide range of currencies.

The Chinese yuan gives up positions for the second day in a row, returning to the levels of the beginning of the month. EURUSD stalled on the way to growth above 1.1200. Similarly, the German DAX has been correcting slightly since yesterday’s spike in the morning.

It seems that the markets need not only a technical correction to reality but also a psychological one. And it may well happen this or next week on the background of ECB and Fed meetings and US employment data.

The FxPro Analyst Team