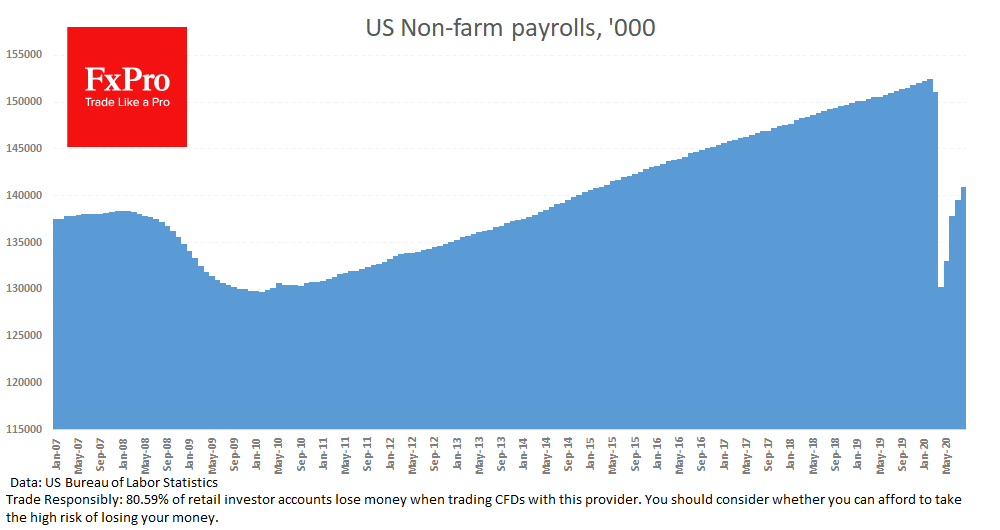

The US labour market created 1,371K jobs in August, which was very close to expectations. In four months of recovery, the US has returned 48% of the jobs lost in March and April. However, with the acceleration of wage growth, total payments accounted for almost two-thirds of their flop earlier this year.

Overall, hourly wages rose by 4.7% YoY, which is good for new job seekers and also interrupts the multi-year trend of sluggish earnings growth with low unemployment. It turned out that an 80-year unemployment high, not a 50-year low, was needed to accelerate the pace.

Although the loss from the lockdown is still far from fully recovered, the US labour market continues to present positive surprises. In this case, robust reports are also positive for the US stock market. Also, Nonfarm payrolls data can provide moderate support for the dollar by returning international investors’ interest in US assets.

The FxPro Analyst Team