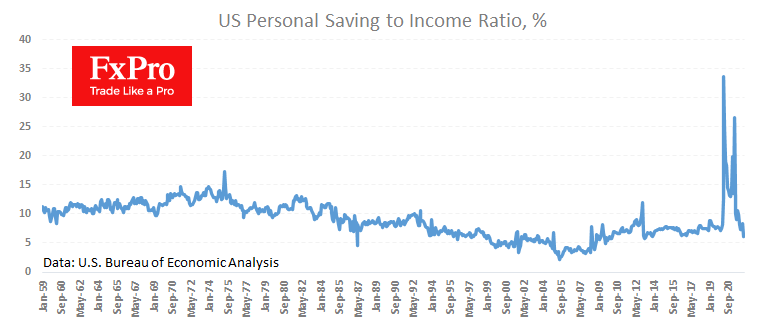

American households increased spending by 0.2% in February, compared with a 0.5% rise in income. But this data only looks optimistic at first glance. Americans saved 6.3% of disposable income compared to 6.1% in January. In other words, we are seeing a stabilisation at levels that last occurred 12 years ago.

The decline in the propensity to save can easily be explained by higher inflation, just like in the first decade of the 21st century. While people largely ignore inflation of 2%, a 7% price increase burns up the value of money stored under the mattress rather quickly.

Inflation is also a significant incentive to return to the labour market searching for work. An indirect confirmation of this is the weekly jobless claims data. Initial claims rose from 188K the week before to 202K. But the number of continued claims has dipped to 1.307M, last seen at the end of 1969.

The published data is good for the Dollar as it sets the stage for a more aggressive policy tightening from the Fed. But the statistics are neutral for the stock market, where participants take the strong labour market as carte blanche for the FOMC to put more pressure on the policy tightening pedal.

The FxPro Analyst Team