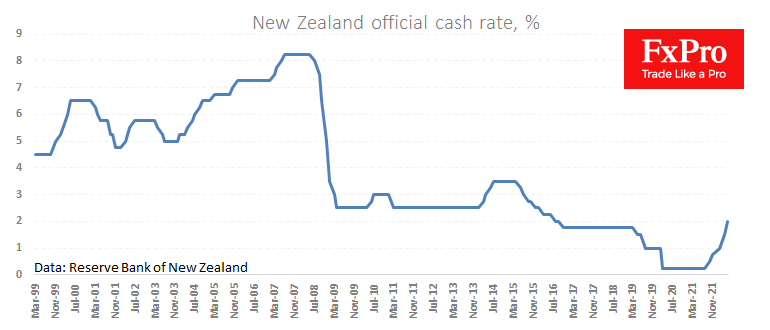

More and more developed central banks are coming out with the pace of policy tightening in the USA. This morning the Reserve Bank of New Zealand raised its rate by 50 points to 2.0%, repeating its move in April. Analysts expected the decision, but NZDUSD strengthened by 1.4% to levels above 0.6500 hours after the decision.

Buyers were attracted by comments from the RBNZ on its willingness to continue to tighten monetary conditions. In today’s commentary, policymakers point out that raising the rate sooner and faster reduces the risk that inflation becomes sustainable. In its very hawkish comments, the RBNZ hints at a willingness to slow economic demand, i.e., slow growth.

Since the beginning of last week, the NZDUSD has shown substantial gains after touching levels near 0.6200. Technical analysis points to a relatively bullish outlook for the pair. The RSI index has reversed to growth on the weekly timeframes after touching oversold levels. On the daily charts, the bullish divergence of the RSI and the price chart also indicates the potential for further growth.

The NZDUSD has corrected 23.6% from the February 2021 peak to the early May 2022 bottom, potentially paving the way for a stronger recovery towards 0.6700 due to the latest bounce. However, with the RBNZ’s resolve and the country’s favourable export conditions, we could well see the beginning of an extended kiwi trend which could return to 0.7200 in the next 12 months.

The RBNZ example looks like one of the first indications of a broader trend, where other global central banks will adopt the Fed’s speed. Possibly they can surpass it, as they have done so many times in history, which would form a retreat of the dollar after almost a year of gains.

The FxPro Analyst Team