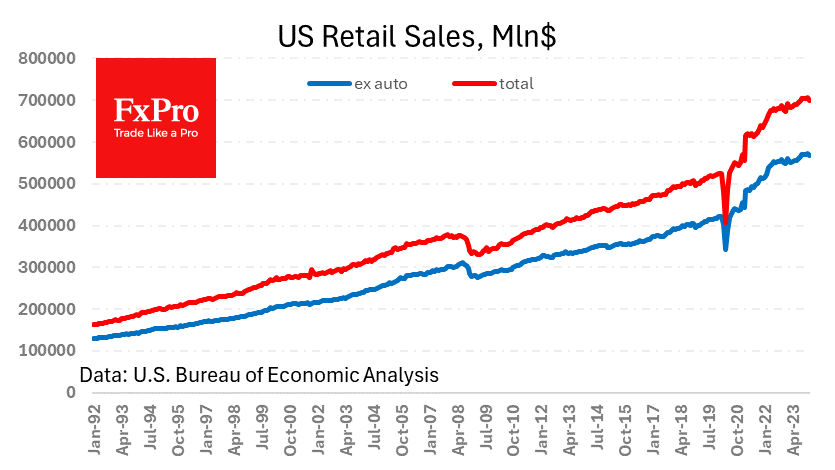

US retail sales fell 0.8% in January instead of the expected 0.2% decline. Sales excluding autos fell 0.6% instead of the expected 0.2% rise. This drop took sales back to their lowest level since last July. Fuel sales last month were at their lowest level since October 2021, while building materials sales were at their lowest level since September this year.

US retail sales are calculated in nominal terms (not adjusted for inflation) and are now 1.1% higher than a year ago. This is well below the 3.1% year-on-year rise in prices and could be seen as a deflation of consumer activity despite the strong labour market.

Today’s industrial production figures also disappointed, with a 0.1% decline in the headline index (expected +0.2% after 0.0% in the previous two months).

The American consumer is the primary driver of the economy, and industrial production, which accounts for around 10% of GDP, is often a leading indicator of the economic cycle. Both of these critical indicators have simultaneously pointed to an alarming and sudden slowdown. This should give pause to those who assume that monetary easing is imminent but are putting a new spin on it. It may no longer be a glorious victory over inflation without a recession but a concern for economic growth and an attempt to ease monetary conditions to cushion the decline.

This is negative news for the dollar as it has the potential to push markets closer to the expected date of the rate cut. In the short term, equity indices may take this news as a positive. However, for the long-term investor, it is clearly a cloud on the horizon that brings the bull market in equities closer to breaking.

The FxPro Analyst Team