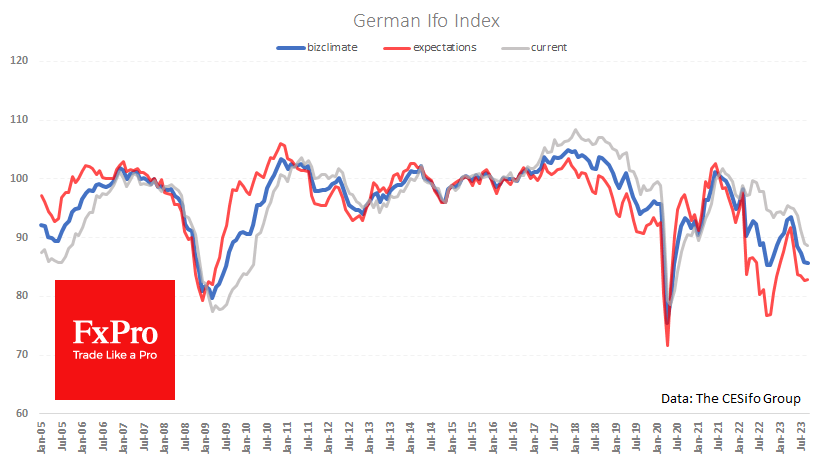

Germany’s Ifo business climate index held steady in September at the previous month’s level despite expectations of further deterioration.

The business climate indicator fell from 85.8 to 85.7, better than the expected 85.1 but still the lowest since mid-2020. Excluding this spike, the only time in modern history that sentiment was worse was in the nine months between November 2008 and July 2009.

The Current Situation Index is trying to find a floor, falling from 89.0 to 88.7. Expectations have slightly improved, with the relevant component rising from 82.7 to 82.9. It may be too early to talk about a turnaround, but previous turning points in this component have coincided with the EURUSD’s turnaround in the following months. From this perspective, it is a reliable leading indicator for the markets.

On previous occasions, however, the expectations index reversed sharply because of monetary easing and fiscal stimulus. This is not the case now, and the improvement in sentiment is in response to a period of low gas prices and slowing inflation. However, neither the issue of reliable gas supplies and energy prices in general nor the slowdown in inflation has been resolved.

Moreover, the ECB raised interest rates less than two weeks ago, in contrast to sharp cuts on previous occasions when business sentiment in Germany and the eurozone was similarly low. A further deterioration in sentiment cannot be ruled out without support from the government and ECB measures. In these circumstances, the scenario of a weaker single currency directly correlated with risk appetite remains a priority.

The FxPro Analyst Team