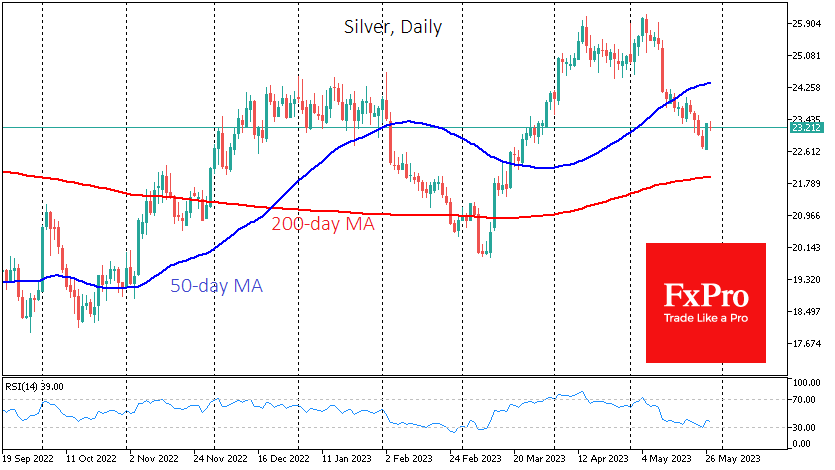

Silver jumped 2.8% on Friday, an important signal of the end of the bearish momentum that has seen the price fall by more than 13% in three weeks.

Although silver is resting on Monday along with most developed markets, Friday’s rally lets us speculate that we have seen more than profit-taking.

A strong bullish candle by a wide margin overcame Thursday’s decline and most of Wednesday’s, to produce the strongest daily gain since the 4th.

We also note that Friday’s bounce came from an oversold RSI on the daily timeframe, erasing just over half of the gains from the March lows.

The bounce in silver could take the price back to $24, a key circular level, relatively quickly.

Silver is often the canary in the mine for gold. If the former finds buyers’ support later this week, the same reversal can be expected for gold.

However, silver could also see a deeper correction to the $22 area, which is now the 200-day average.

The FxPro Analyst Team