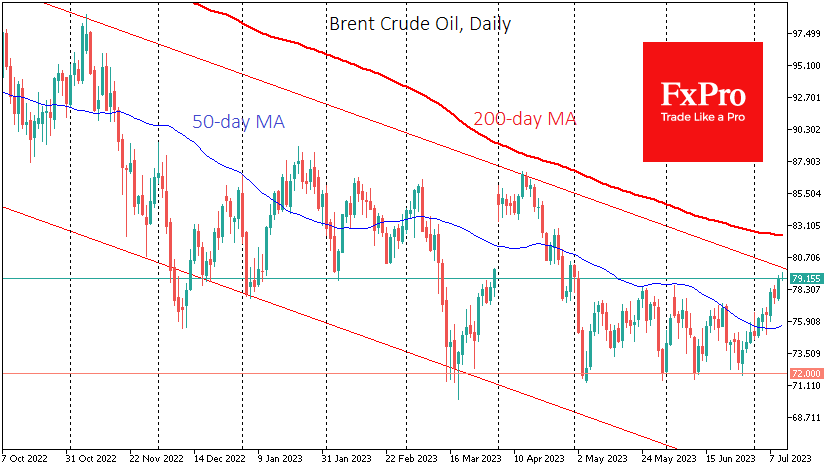

Crude oil has rallied more than 10% from the lows two weeks ago. The price of a barrel of Brent rose above $79.50 on Wednesday, its highest level since early May. But the easy part of the journey for the bulls may be over, and a severe battle to stay within the year-long downtrend is now beginning.

The actions of the OPEC+ members since March have drawn a clear horizontal line of support for the price, as supply reduction interventions have almost always followed the price closer to $72.

Thanks to a relatively strong labour market and a weaker dollar since the beginning of the month, oil has climbed to levels it was reluctant to breach in May and June.

However, this rise is all within the downtrend that has been in place since last July, and the latest spike has taken the price to the upper boundary of this downtrend.

On the technical side, the most exciting part is now beginning, as we are about to witness a battle for the trend, which promises a surge in volatility.

A further rally and the ability to consolidate above $80 will be the first signal to break the downtrend. If the bears retreat quickly here, we could see a rapid rise to $82.50, close to the 200-day moving average. The final break of the year-long downtrend would only be a move above the previous highs at $87.

However, the more likely scenario is a pullback within the range and at least a retest of critical support. The maximum would be a break of this line and a move lower. On the side of this scenario are fundamental factors in the form of China’s slowdown, which has proved unresponsive to the announced stimulus measures, and growing signs of contraction in the major developed economies under interest rate pressure.

From a technical point of view, the downtrend remains in place until a reversal is confirmed. In this case, be prepared for Brent crude to return to $72 this month and for an attempt to storm this key OPEC+ support line next month. This is also where the 200-week moving average is, and a sharp break below it could have the effect of a dam bursting, as it did in 2020 or 2014.

The FxPro Analyst Team