Trouble is piling up for the US. After trade wars, fiscal issues are now weighing on the dollar. Moody’s became the latest major agency to strip the US of its highest credit rating. Lawmakers passed a controversial, sweeping tax cut bill by a slim margin. A weak auction of 20-year Treasury bonds gave rise to concerns about cooling demand for treasuries from foreign investors. Finally, threats to raise tariffs on imported iPhones to 25% and on EU goods to 50%, brought back the relevance of the early April trade with simultaneous declines in stocks, bonds and the dollar.

As a result, the ‘sell America’ trade returned with renewed vigour. Among the main casualties has been the US dollar. The White House policy has shaken confidence in it, and rumours of coordinated currency intervention after the G7 summit in Canada are stirring the imagination of USD bears. And then there are the fiscal problems. Should we be surprised by the fall of the US currency?

After the Plaza Accord in 1985, the main beneficiaries of interventions were European currencies and the Japanese yen. Now, they are EUR and JPY, with a weight in DXY of 57.6% and 13.6%, respectively, so the dollar has nothing to do but return to decline.

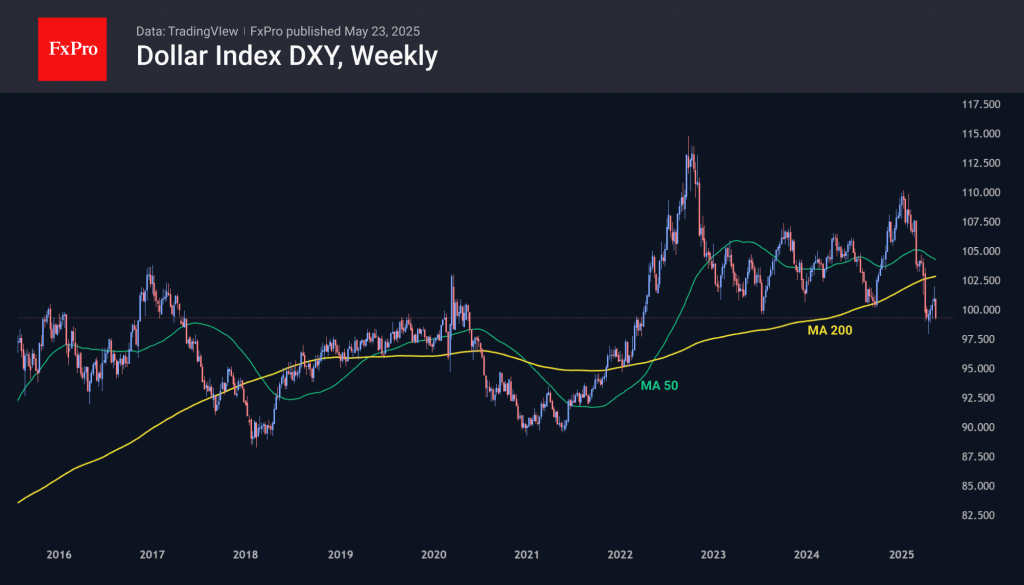

The retreat in the last five days after four weeks of recovery has taken the dollar index back to the area below 2023 and 2024. All eyes are now on the area of this year’s lows, which are 1.5% below current levels. A failure below them will confirm the end of the corrective rebound and the beginning of the downside momentum into the 90 area to the 2021 and 2018 lows.

The FxPro Analyst Team