Greece is selling debt for the second time this year, taking advantage of lower borrowing costs after an upgrade from Moody’s Investors Service. The nation has mandated six banks as lead managers for a new 10-year bond, according to an Athens bourse filing on Monday. The sale is expected to be on Tuesday, a government official said on condition of anonymity, as there is no final decision yet. Greece last sold similar maturity debt in November 2017 as part of a bond exchange and before that syndicated 10-year bonds in 2010.

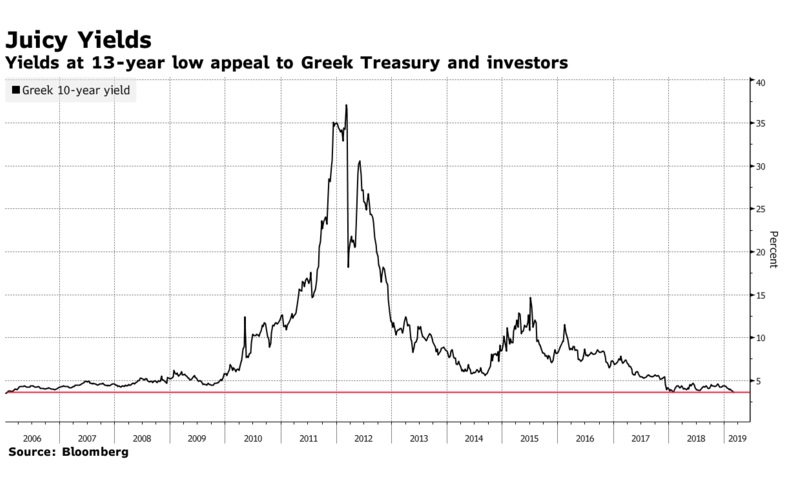

The latest sale marks another step in the country’s rehabilitation for markets since the euro-area debt crisis, following a move by Moody’s to raise Greece’s sovereign rating by two notches to B1 with a stable outlook on Friday. While Greek debt has outperformed the euro area this year to take yields to a 13-year low, investors are likely to be attracted to the offering since the securities still offer the highest returns in the region.

The Moody’s rating is still four notches below investment grade, though could go someway to reassuring high-yield investors. The offering also comes off the back of unprecedented demand for euro-area debt so far this year, with concern about slowing growth in the region damping the prospect of the European Central Bank raising interest rates anytime soon.

Greek 10-year bonds currently yield around 3.67 percent, compared with 2.76 percent on their Italian peers and 0.17 percent on German securities. At the height of the financial crisis, Greek bonds yielded as much as 44 percent. Still, trading in Greek government securities remains scant. Bank of Greece data show that turnover on the electronic secondary securities market, or HDAT, totaled less than one billion euros in February, compared with a peak of 136 billion euros in September 2004.

Greece Is Back in the Bond Market as Yields Fall to 13-Year Low, Bloomberg, Mar 04