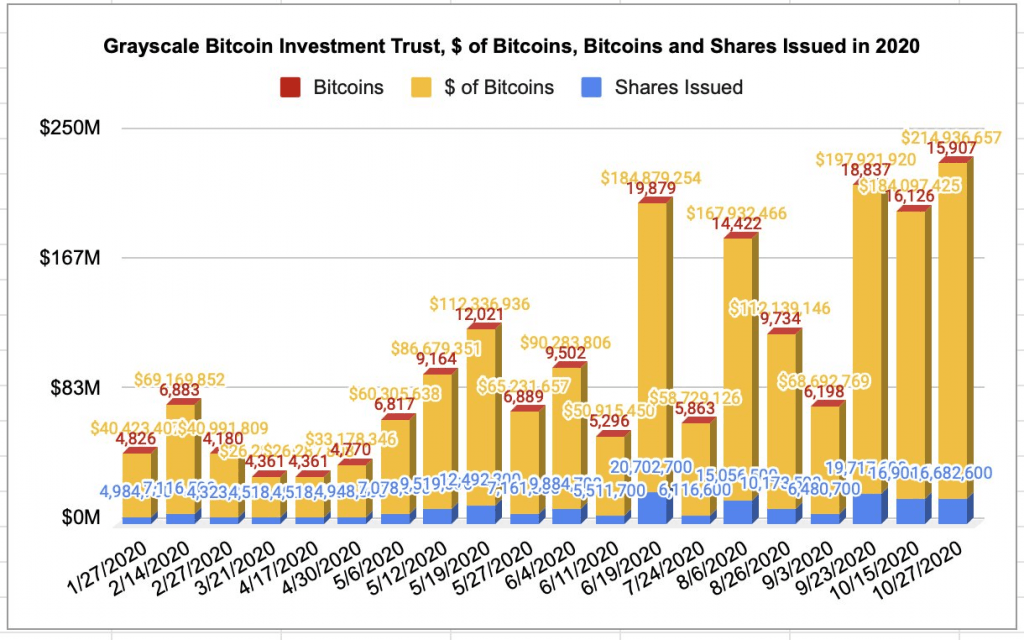

Grayscale’s Bitcoin (BTC) Trust is on track to reach 500,000 BTC by the end of 2020. Last week, Grayscale saw a record inflow of $215 million (15,907 BTC) that surpassed all previous investments into the Trust. The firm now holds $6.7 billion (481,711 BTC) as of the time of writing.

Should the firm continue last month’s growth-rate of 32,000 BTC, Grayscale in on track to hold 500,000 BTC (2.7% of circulating supply) within three weeks. By the end of next year, if the rate is consistent, Grayscale could control 926,600 BTC — equal to 5% of Bitcoin’s total current supply.

The Trust, created in September 2013, has seen explosive growth this year, with its assets under management (AUM) growing from $1.9 billion to $4.7 billion in the first nine months of 2020. Since Grayscale’s Q3 report, the AUM of its Bitcoin Trust has grown by an additional $2 billion.

Almost 70% of Grayscale’s total weekly inflows were invested into its Bitcoin Trust over the past three quarters. Bitcoin Trust weekly inflows grew from a 12-month average of $39.5 million to more than $55 million in Q3, 84% of which was attributed to institutional investors.

Grayscale Trust sees largest-ever weekly inflow, nears 500K BTC in total, CoinTelegraph, Nov 4