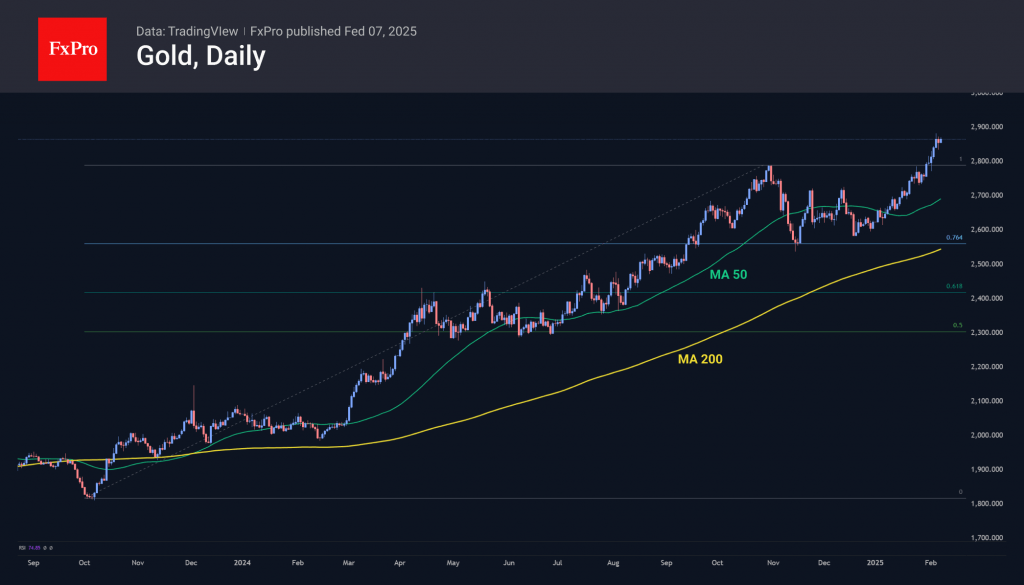

Gold prices reached all-time highs at the end of last month and have continued to climb steadily into the first week of February. This marks the sixth consecutive bullish weekly candle, with a 2.5% gain over the past seven days. This performance is noteworthy, especially given the fluctuations in most other markets.

From a technical perspective, gold is starting a Fibonacci extension pattern. The global rally commenced in October 2023 following initial signals from the Federal Reserve indicating an easing of monetary policy and a subsequent slowdown in the pace of rate hikes. Between October and November 2024, after appreciating by 55% to reach the $2790 level, gold experienced significant profit-taking, resulting in a pullback to $2550, which represents 76.4% of the initial rally. This was followed by several weeks of intense trading between bullish and bearish market participants.

By the end of December, steady buying momentum had returned to the gold market. A move above $2800 in late January has led to discussions about the potential onset of a new global growth wave. If this trend continues, the price of gold may potentially reach the $3400 per troy ounce area between August and October of this year.

In contrast, silver remains more subdued, currently sitting 7% below its highs from October last year. However, it has shown strong performance over the past week. Should gold continue its upward trajectory, silver is expected to rise at a faster pace, thereby recovering lost ground.

The FxPro Analyst Team