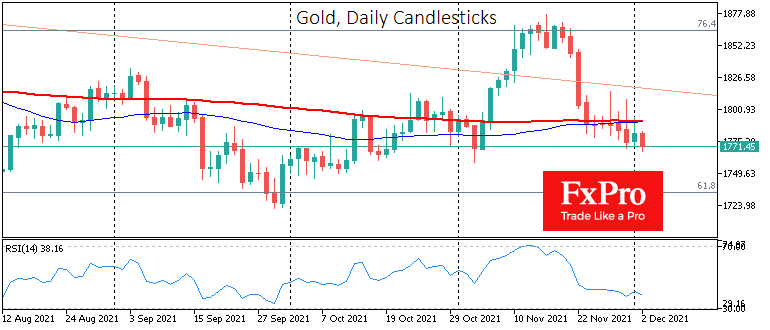

Gold is cruising near the lows of the last four weeks and became heavy with the Omicron news. The series of lower intraday peaks indicates disappointment in the outlook for gold by those players who have been buying it up since early October.

Gold’s pullback of almost $100 to $1775 has virtually erased the gains since early November but, more importantly, pushed the price below significant technical and psychological levels. Since November 23rd, gold has been moving closely around the 50- and 200-day moving averages and it was in perfect balance for a few days, closing the day near the opening levels. However, by the end of the month, the bears seem to have become the prevailing force.

On the fundamental side, hawkish Fed rhetoric is playing against gold, setting up for a quicker QE rollback and rate hike, reducing interest in gold as insurance against inflation getting out of the central bank’s control.

It’s worth assuming that the local bearish momentum on gold will stay with us in the coming days, opening the potential for a drop to $1730 or even $1680. At those levels, the task of bears will be much harder, because there is strong support that the bulls managed to defend for the last 9 months.

A consolidation under $1730 would be a strong signal that the situation went beyond the pullback after the two-year growth and consolidation before a new growth wave. A failure at $1680 would be a tell-tale signal in this case. That turn of events would be a clear indication that 2020-2021 is the same for gold as 2011-2012, which saw a peak for many years ahead, and it opens the road down to the area of $1300-1500 in the coming year for gold.

Alternatively, the ability to quickly return above the important moving averages to sustained growth would cause a pullback and consolidation from the current situation, followed by a new spurt to $2600 in a year.

The FxPro Analyst Team