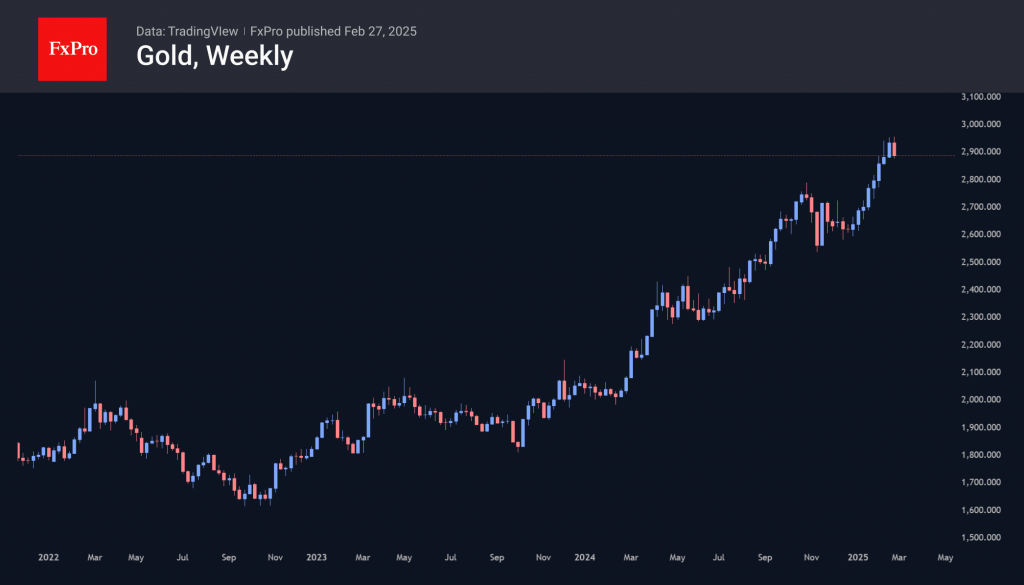

Gold has seen its first decline after eight weeks of gains. After starting the week with an attempt to renew its highs, the precious metal has been hit by a more intense sell-off. We saw a similar dynamic at the beginning of February, suggesting that sellers are very active at current levels.

The increased push into US government bonds well explains this momentum. Investors moved into long-term US Treasuries in response to the many initiatives by the current President’s administration to reduce the national budget. The market reaction is not a measure of the effectiveness of these initiatives, but it is sufficiently focused at this stage.

The potential pullback in gold allows us to consider the $2800 area as a potential target for the current downside momentum from 2955. This is the area of the peak at the end of October last year and the 61.8% Fibonacci retracement level. A break below would signal the beginning of a reversal to the downside.