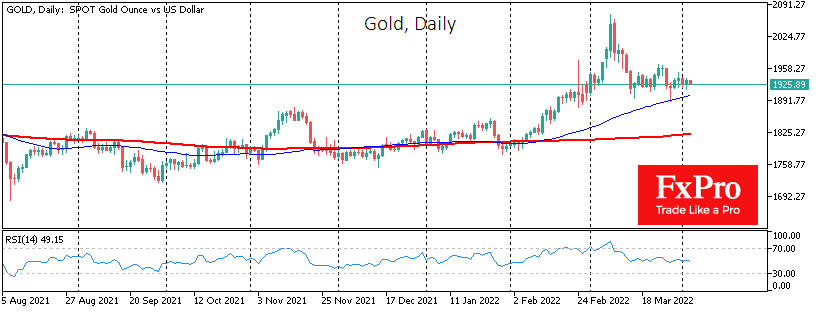

Gold has found a balance, stabilising at around $1930. The pullback in gold from the highs reached on the 8th of March was in unison with the rebound in stock indices, i.e., reflecting capital flow from the safe harbour into equities.

The ongoing sanctions prevent the equity market from rising further. Still, there is also another buyer of gold – namely the Bank of Russia, which is committed to buying gold at 5,000 RUB per gram. The gold pullback and the rouble rise have reduced the initial discount from 20% to 3%, which we have seen over the last six trading sessions.

Russia is trying to loosen the capital controls very carefully, which is a positive move for the economy but potentially harmful to the rouble. A USDRUB recovery to pre-February 23rd levels does not fit the new reality with a falling domestic economy and diminishing prospects for export earnings.

A return to rouble depreciation would open the way for gold to fall, but until then, it is hardly prudent to bet against it. A sharp easing from the Bank of Russia in the coming days is unlikely to be expected, which could collapse the rouble, as it would further boost inflation. Although the price of gold has been moving around current levels for the last 15 trading days, there are more upside risks.

The FxPro Analyst Team