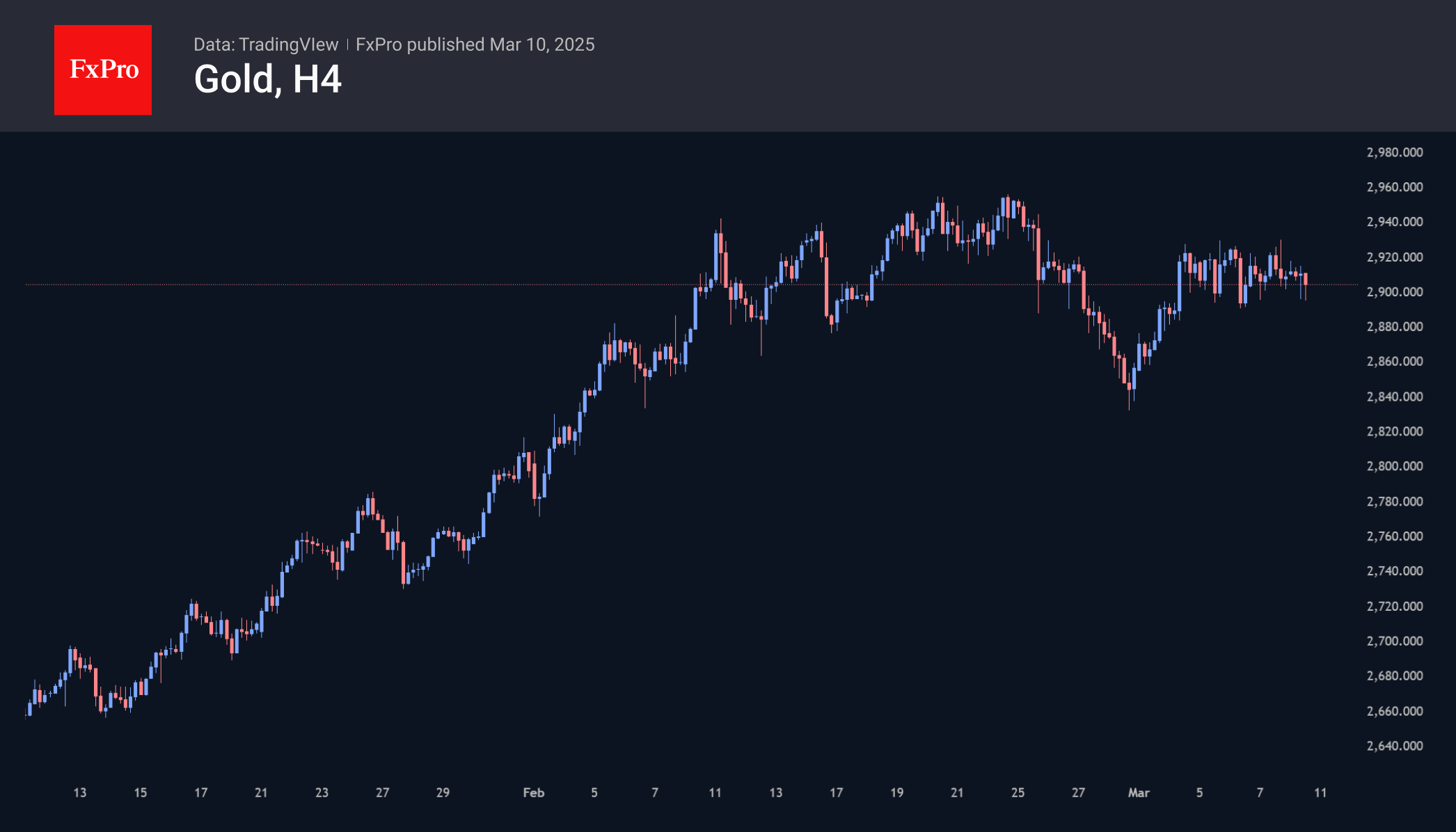

Since early March, the gold price has reversed to the upside, regularly exceeding the $2900 mark during the week. The cautious trading tone of the US indices works on the side of the bears, while the weakness of the dollar infuses confidence in the bulls.

On the tech analysis side, the dip at the end of last month now looks like a corrective pullback from the rally from the beginning of the year. If this is the case, overcoming the highs above $2950 opens the way to $3180. Gold bulls should still look at the sentiment around US equities. Further declines could switch the market into global deleveraging mode, and gold will initially have a tough time.

The FxPro Analyst Team