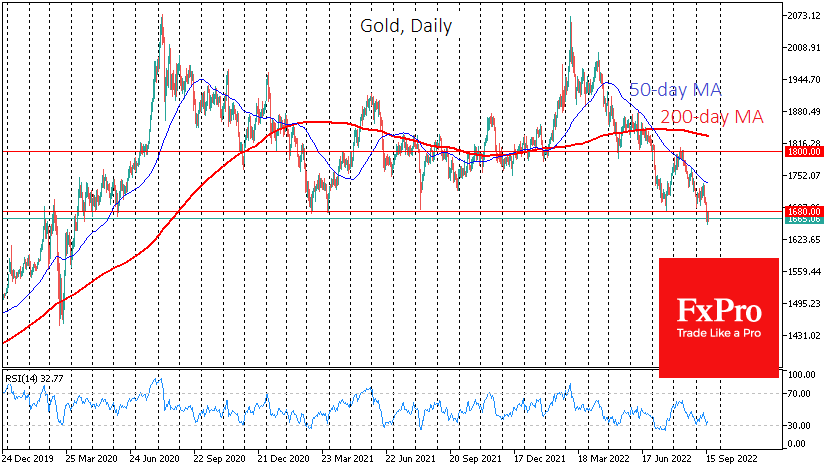

Gold’s timid attempts to push back from the lower end of a more than two-year range were foiled by a stiff market reaction to US inflation statistics. Gold plunged to $1660 on Friday, rewriting its low from April 2020, while buying has been rising for the last 19 months just after touching the $1680 area.

Notably, gold reversed sharply last month from the round level of $1800, which had acted as support several times between February and June. Thus, the gold bulls are one by one, giving away the technical levels that were significant before.

In addition to the consistent retreat from the horizontal levels, we note that the downwardly directed 50-day moving average has been acting as local resistance since June. Last week’s last downward momentum was precisely from this curve.

The move to higher timeframes generates even more worries about the outlook for gold. Gold closed last week a hair above its 200-week moving average. That was mainly due to Friday’s local bounce, as the bears were lowering profits from the big move. The start of the new week is under this curve. The fall under it in 2013 and the inability to get a foothold over it in 2016 were followed by a strong sell-off, which is a worrying sign now.

A test of the 200-week average is a once in a few years event that can set the trend for years to come, and the forthcoming Fed meeting this week provides a meaningful macroeconomic backdrop for this choice.

If the Fed’s decisions and Powell’s comments prove to be as adamant about fighting inflation as the markets now expect, we could see a repeat of the 2013-2015 pattern of gold’s failure. Back then, a breakout of the lower end of the sideways range in 2.5 years of the steady decline took more than 30% off the price. A similar failure will wipe out all the gains from 2018, returning to the $1170 area over the next two years.

However, on our side, the odds are now slightly outweighed that the FOMC will shift the rhetoric towards easing, as the markets had expected since June. But they seem to have dropped that idea last week after the inflation report, and we note that it was quite a minor upshot. Moreover, long-term inflation expectations have already returned to normal. In addition, there are increasing signs that financial markets are under stress, which the Fed will also consider when setting policy.

Looking at financial markets in favour of the Fed indicates that the committee has slowed down asset sales from the balance sheet, increasingly deviating from its declared trajectory. Excessive stress on financial markets can effectively shut down the economy and turn around the labour market.

If the markets perceive current prices as profitable for gold and miners to buy, this week, we could see the formation of a long-term wave that could take gold above $2600 for the next two years.

The FxPro Analyst Team