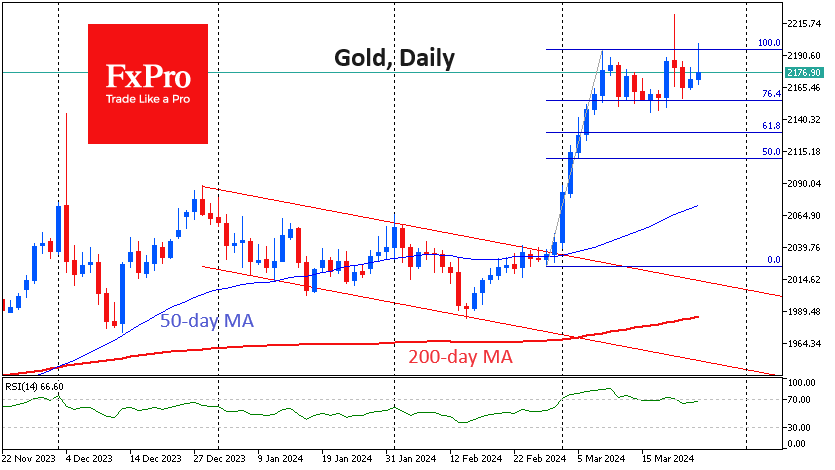

Gold breached the $2200 mark for the second time in history on Tuesday before retreating to $2182 in early US trading. Cryptocurrencies are trading in the same direction as gold today, but silver, platinum and copper are failing to make similar gains, causing some unease.

Gold’s break above $2195 tested the rally high from late February to 8th March. A fix above this level would be the first step towards a new rally, making the scenario of growth to $2300 viable.

Strictly speaking, there is a higher price on the charts, but it is the result of slippage in low liquidity trading, so it is not considered a full-fledged breakout.

Silver is losing ground daily for the fourth consecutive session, falling to $24.4. Platinum is trading near $900 – near local lows after a 5% pullback from its 15th March high. Copper has been trending lower since early last week.

Gold is the most liquid metal in the exchange, but its divergence from other metals is setting it up for a false breakout on Tuesday.

This is evidenced by the persistent sideways movement in gold miners over the past three weeks despite gold’s impressive rally.

Technically, gold needs to consolidate above $2200 to start a new bullish momentum. In the event of further declines, we should keep an eye on the dynamics around $2150: a failure of this support could trigger a deeper correction with the first target at $2130.

The FxPro Analyst Team