Gold is trading near $1819 an ounce, unable to take advantage of a spike in geopolitical risks due to an environment of rising interest rates. Two-year US government bond yields have reached 1.06%, pre-pandemic levels.

Rising yields on expectations of a sharp Fed key rate hike this year (compared to the previous tightening cycle) are putting pressure on the stock market, where Nasdaq futures are losing 1.3% since the start of the day and 9% from their late November peak.

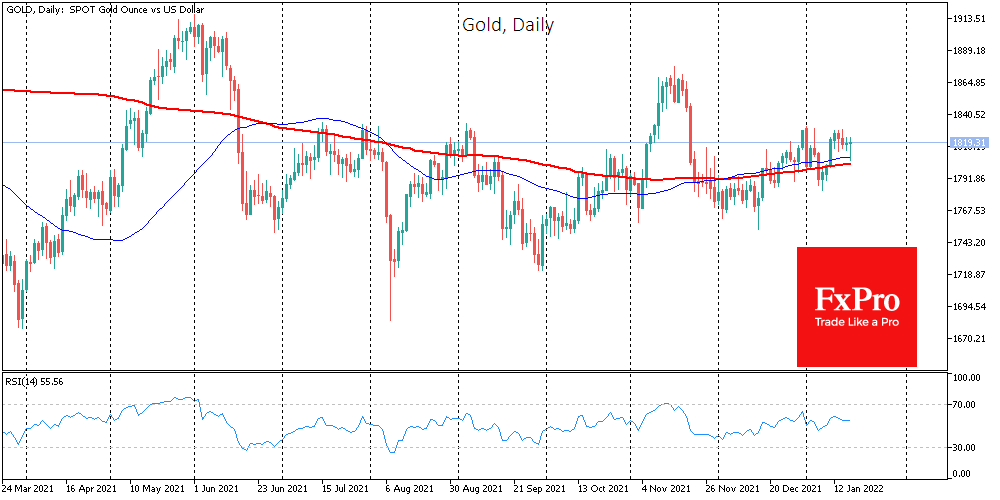

The debt market’s continued reassessment of the outlook for monetary policy is a serious threat to gold. Its price is now above the 50- and 200-day moving averages, reflecting the strength of buyers in previous months.

We have also previously noted a sequence of increasingly higher local lows. But as the market enters higher levels of volatility, previous local support levels might not hold.

While in previous days we could see gold strengthening along with growth stocks falling, there are now increasing signs that the sell-off in the markets is taking on a global nature, affecting almost all asset classes. In this environment, a break of the upward support line (now around $1800) can only further increase the volatility of gold prices. Further sell-offs in equities could send gold to retest the $1760-1770 area before the end of the week. If it fails as well, we could see a very quick dip towards $1730 or even $1680.

The FxPro Analyst Team