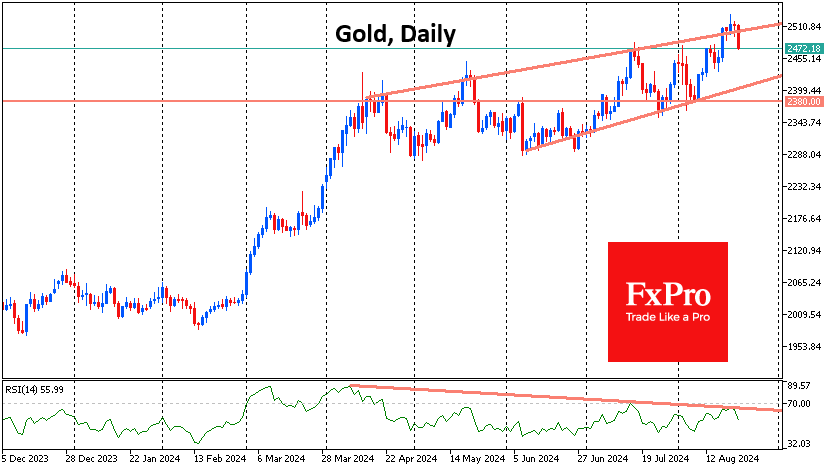

Gold started the week with a decisive renewal of all-time highs, reaching the maximum spot price of $2531 per troy ounce. However, the bulls failed to seize the initiative finally, and on Thursday, gold lost more than 1%, falling back to the depths of the upward trend established in April.

We also pay attention to the exhaustion of the growth momentum. On daily timeframes, a divergence is forming between a sequence of increasingly higher price highs and increasingly lower RSI highs. This is considered a harbinger of a deeper dive, and significantly, the most recent reversal occurred from levels below the overbought area. Thus, it is worth paying attention to how events will unfold next.

Trading within the above trend opens the door for a relatively quick pullback to $2420. It will be possible to speak about the break of the upward trend only when the price falls below $2380 – the previous local lows.

The FxPro Analyst Team