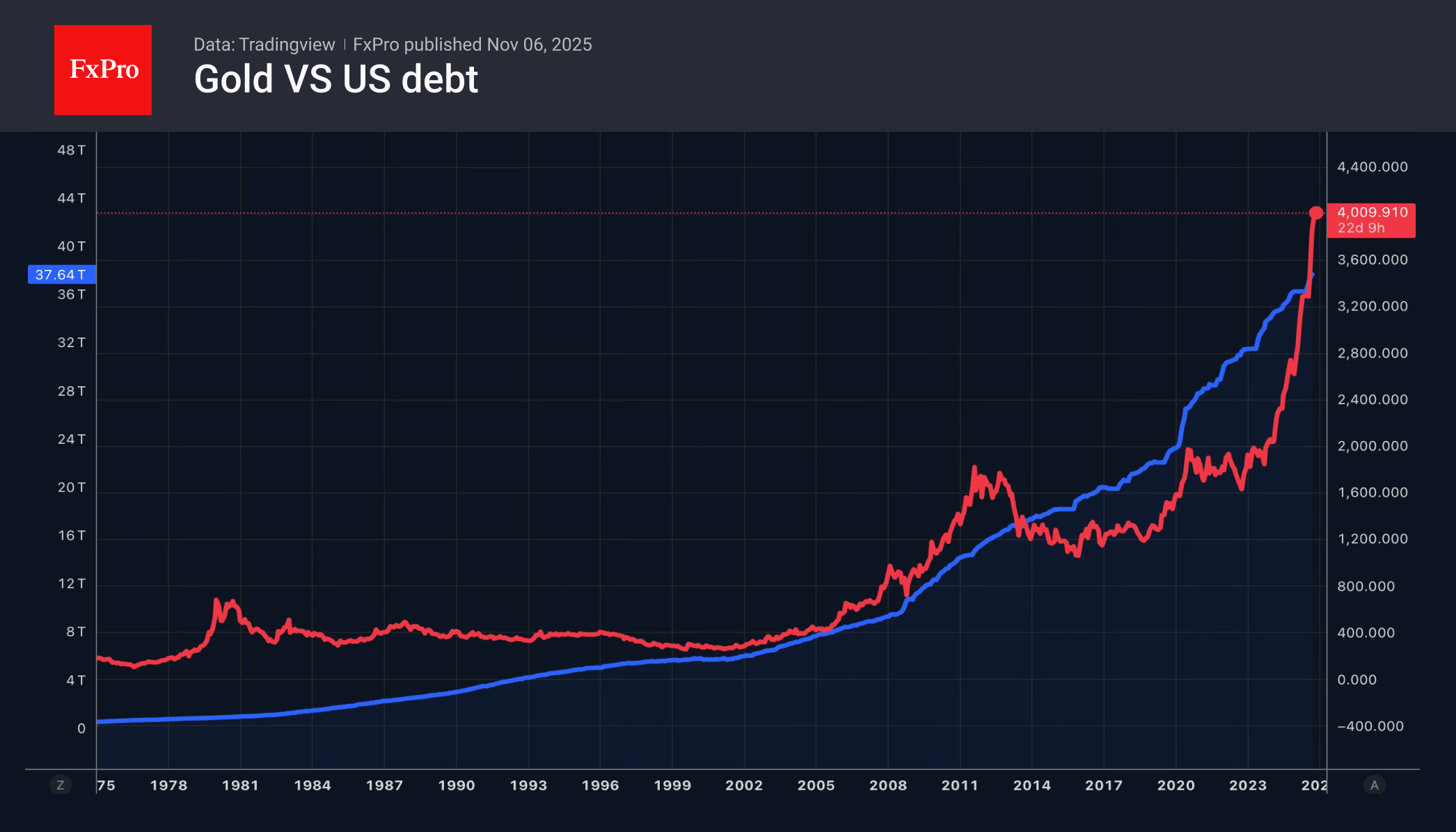

Gold has stabilised around the $4,000 mark over the last ten days, ending the week at roughly the same level as it started. Attempts by sellers to push the price below $3,900 are meeting with impressive buying interest.

This is facilitated by the Supreme Court, which is considering the illegality of US tariffs. If Donald Trump is defeated, the money will have to be returned. As a result, the budget deficit and public debt will increase, leading to chaos in the financial markets. Concerns about this are prompting investors to seek refuge in safe-haven assets. However, this all appears to be an attempt to play the old card, which can only delay the inevitable.

According to estimates by the World Gold Council, central bank purchases of bullion in 2025 are expected to amount to 750-900 tonnes. In each of the previous three years, the figure exceeded 1,000 tonnes. China’s cancellation of VAT credits for precious metal retailers will increase prices for the jewellery industry and lead to a decline in demand. ETF stocks are falling.

HSBC, Bank of America and Societe Generale continue to stick to their forecasts of $5,000 per ounce. However, the gold rally has broken down. Selling on the rise is becoming relevant.

The FxPro Analyst Team