The price of a troy ounce of gold fell 1.4% on Wednesday to $1875, its most significant drop since early June, building this week’s loss to 2.7%. Gold has not been so cheap in Dollars since the first half of March when the problems of US regional banks triggered a surge in interest in the metal. That situation put pressure on the dollar, but the picture has changed dramatically.

US government bonds are experiencing a solid capital inflow from domestic investors, for whom the current yield levels look very attractive. Against this backdrop, the gold bulls are capitulating.

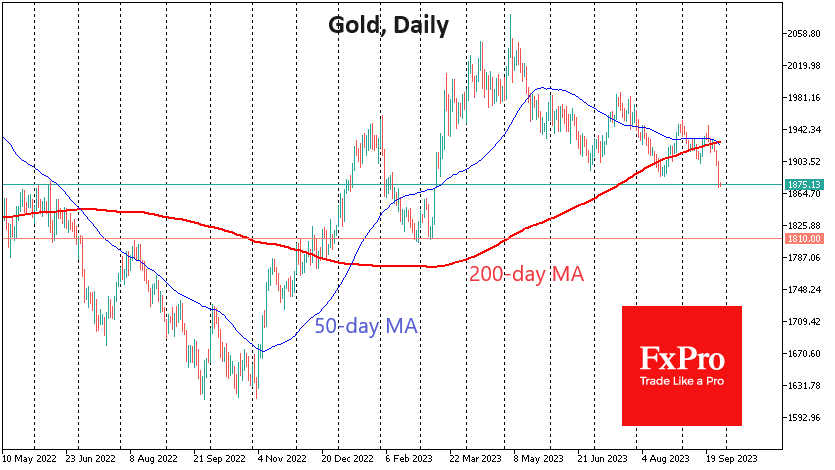

Technical factors partly support the sell-off. Gold formed a “death cross” yesterday when the 50-day moving average crossed below the 200-day moving average—however, the fast MA has acted as stiff resistance since last Monday.

While Wednesday’s move in gold was impressive, history suggests that this is unlikely to be the final leg of the decline. The case of the previous death cross in July 2022 is very similar to the current one. And back then, the price was down 7%. Even earlier, in February 2021, the sell-off stopped after only a 9% drop; in August of the same year, it was down almost 7%.

In all these cases, gold pulled back to a previous significant support area before we saw a corrective pullback. The following considerable pivot area in the current situation was $1805-1810.

Mirroring how quickly gold gained $100 from $1810 in March, we could now see an equally quick landing.

But this is where longer-term forces could come into play. The 200-week moving average runs through here. Approaching or briefly dipping below it has attracted big buyers over the past six years.

However, it is essential to note that the $1800 area may become where only some bearish gold positions are fixed. It will be necessary to monitor financial market sentiment very closely. With equity indices continuing to fall and long-term yields rising, a further price fall is quite realistic.

The FxPro Analyst Team