Gold hit three dozen record highs in 2025 and exceeded $3700 per ounce for the first time in history. The precious metal surpassed its inflation-adjusted record set in 1980 and has risen by more than 40% since the beginning of January. This has rarely happened, even during times of global economic crisis and pandemic. Only in 1979, against the backdrop of turmoil in the energy markets and stagflation in the US, was the increase greater than +140%.

Central banks continue to buy bullion as part of the process of de-dollarisation and diversification of gold and foreign exchange reserves. ETF stocks have grown by 43% since the beginning of the year. In terms of value, they have reached a record high. Precious metals are benefiting from a favourable background of falling Treasury yields and a weakening US dollar due to the Fed’s renewed cycle of monetary expansion.

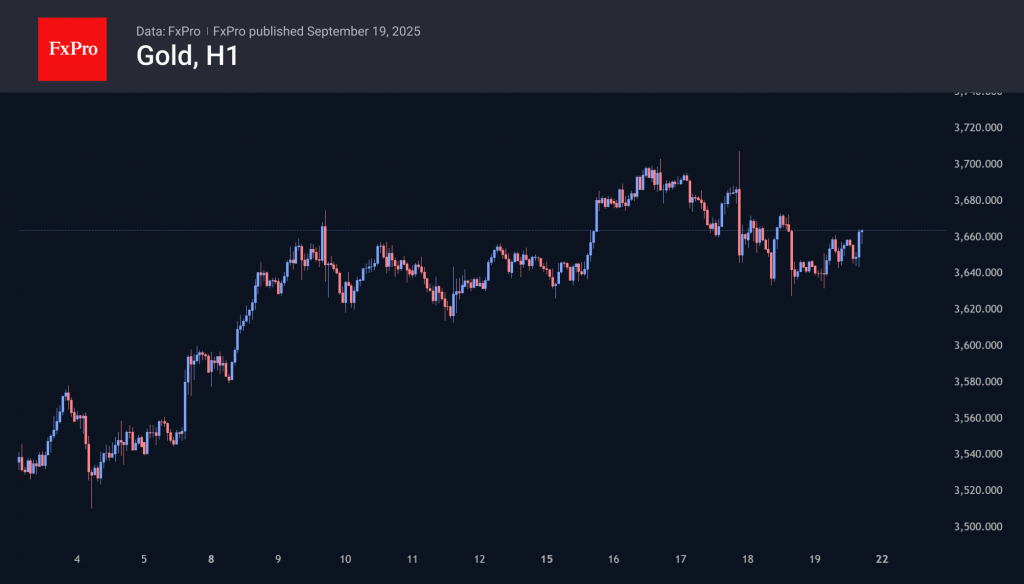

At the same time, however, we note that following the Fed’s decision, the dollar began to rise, and gold began to fall, closing the week near its starting level of $3,650, in contrast to new record highs for stock indices. Markets are temporarily selling gold and buying dollars to buy US stocks.

If this is not the beginning of a new wave of dollar strengthening against fundamental factors, then gold may return to growth in the coming weeks after some shakeout. At the same time, in the short term, the balance of risks is still on the downside. This is not least due to new hopes for a settlement of tariff disputes with China and India, which gold has always offset with declines.

The FxPro Analyst Team