The price of a troy ounce of gold fell to $1890, its lowest level since late February, on reports of significant progress in negotiations between Russia and Ukraine.

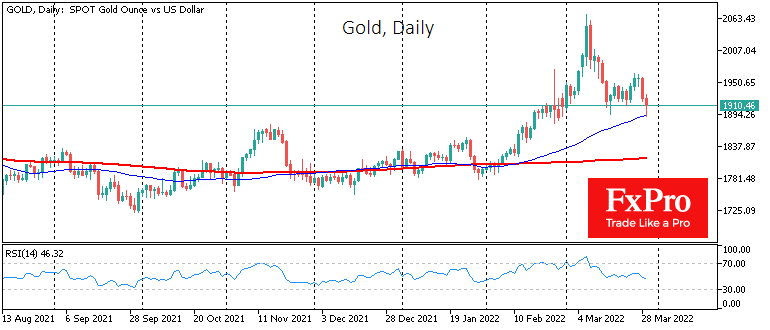

Gold retreated 8.5% from the 8th of March peak, returning to the 50-day moving average line. A consolidation below current levels at the end of the day or, better still, the month would be an important market signal to break the wild trend of the last two months.

From the tech analysis side, a consolidation below this mark would trigger a realisation “Head & Shoulders” scenario with an implied drop towards $1730, with probable significant support at the 200-day moving average (currently at $1820). However, in addition to the geopolitical driver, there remains an inflationary driver in gold.

Investors are buying gold given the significant difference between the inflation rate and the yields in the debt markets. This is an important reason for medium-term gold purchases, which could provide buyers with interest even if there is further military de-escalation.

The FxPro Analyst Team