Hasan Ayhan followed his wife’s instructions last week and took their savings to buy gold at Istanbul’s Grand Bazaar as Turks scooped up bullion worth $7 billion in a just a fortnight. With memories of a currency crisis which rocked Turkey’s economy only two years ago fresh in his mind, the retired police officer was among those playing it safe as he queued in the city’s sprawling covered market, where a screen showed the gold price rise by one Turkish lira ($0.1366) in just 10 minutes.

The day after Ayhan bought his gold on Aug 6, the lira hit a historic low and has remained skittish since, laying bare concerns that Turkey’s reserves have been badly depleted by market interventions, which are showing signs of fizzling out.

Turks have traditionally used gold as savings and there may be as much as 5,000 tonnes of it “under mattresses”, with more added after the recent buying spree, Mehmet Ali Yildirimturk, deputy head of an Istanbul gold shops association, said.

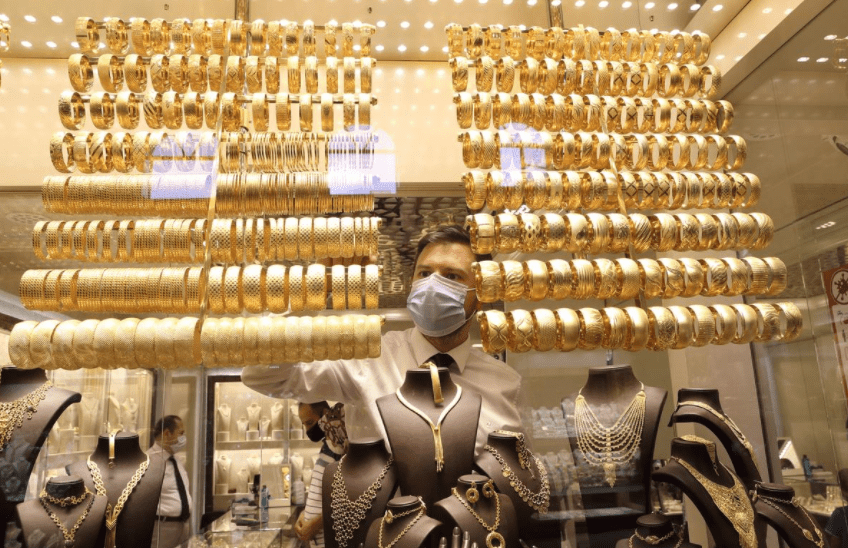

Although bullion has never been more expensive, vendors at the Grand Bazaar said almost no one is coming to sell their gold jewellery. There are only buyers.

In the last three weeks, as selling gripped the lira, local holdings of hard assets such as dollars and gold jumped $15 billion to a record of nearly $220 billion.

There is no evidence suggesting people are about to pull savings from banks, and this week the lira has hovered around 7.3 versus the dollar, although it remains among the worst emerging-market performers this year.

Demand has eased since Turks withdrew some $2 billion in hard foreign cash from their banks during a March-May period in which a lockdown was imposed and the lira hit its last low, according to central bank banknote data.

Analysts say that if Ankara cannot boost confidence in the currency, which has fallen almost 20% this year, import-heavy Turkey risks inflation and even a balance of payments crisis that will worsen fallout from the coronavirus crisis.

Given foreign investors now have only a small stake in Turkish assets, they say the key for President Tayyip Erdogan’s government is convincing Turks and local businesses to stop turning to the perceived stability of dollars and gold.

In turn, the bank’s gross FX buffer has fallen by nearly half this year to below $47 billion, its lowest in years.

Gold rush at Turkish bazaar a test of trust for lowly lira, Reuters, Aug 14