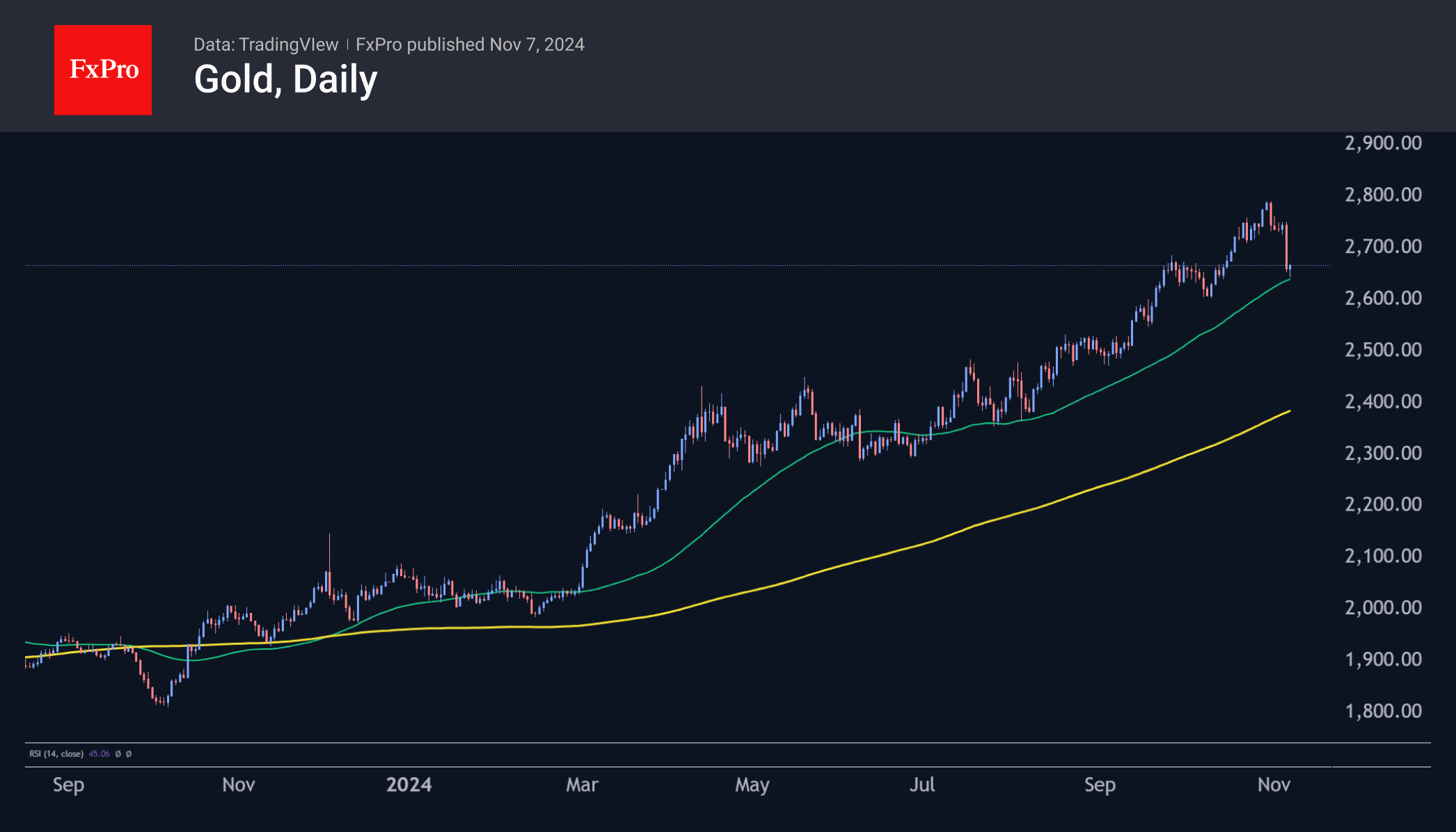

Gold lost over 3% in value on the day the presidential election results were tallied. Cumulatively, from its peak in late October to its most recent low, the losses exceed 5%. So far, it doesn’t look like a tragedy. Gold is just blowing off steam after more than 50% gains from the lows of last October. We attribute the price decline to the fact that a lot of capital parked in gold got involved in the game after the pre-election uncertainty.

Technically, there is a test of an important support line at the 50-day moving average of $2,640. A failure below it will signal the start of a deeper correction to the $2,400 area. A sharp return to growth will allow us to talk about the imminent renewal of historical highs. The latter is a realistic but alternative scenario. It seems to us that now it is more likely that gold will leave the top role for a while.

The FxPro Analyst Team