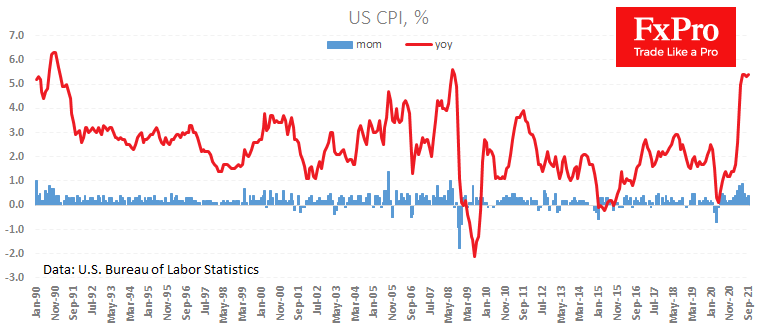

US inflation shows no signs of easing. The headline number returned to 5.4% y/y, the highest since 2008, vs the expected 5.3%. Core CPI stabilised at 4%. That is not to say that the data deviated much from expectations and marked a turning point in the economic cycle. But the first reaction of the markets to this data was as sharp as the NFP release last Friday.

This was particularly so for gold. Buying gold gathered momentum today, taking the price to $1777, from where the seemingly strong CPI figures caused it to plummet to $1757. However, this dip attracted even more furious demand, taking the price to $1785 at the time of writing.

There were big bulls in gold. This was evident from the initial reaction to the NFP, although it proved volatile. However, this week, demand from gold has moved into gold miners’ shares – a leading indicator for an asset. A meaningful sign of a bearish trend reversal in gold would be a consolidation above $1800 and confirmation to overcome previous local highs at $1836.

The FxPro Analyst Team