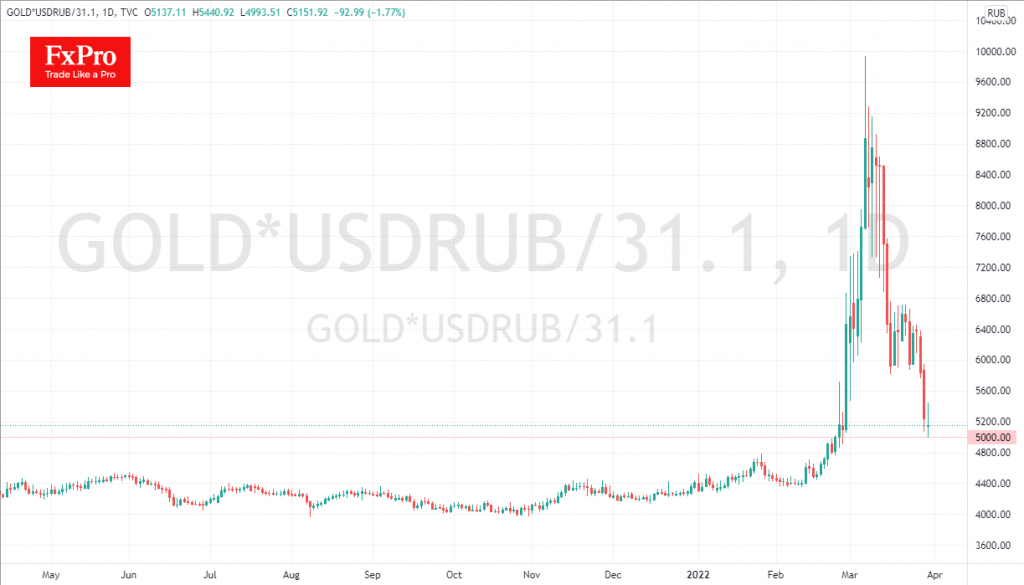

The Bank of Russia last week fixed the purchase price of Gold from banks at 5,000 roubles per gram. At the time of the announcement, on the 25th of March, the Dollar was hovering around 100 roubles, and the price of an ounce (31.1 grams) on the international market was around $1950. Where did that price of 5000 come from? It is a rounding of the ‘global’ gold price at the close of the 23rd of February, converted into roubles.

At that time, the Central Bank offered a 25% discount on the market estimate (6270 RUB). However, this discount has all but disappeared due to the recent rouble appreciation and Gold’s retreat from peaks. At the closing levels of the day, the central bank price was only a 3.3% discount to the global price, and intraday, it fell to 4965 RUB, where we saw a surge of buying due to arbitrage.

Next, we should be prepared for the strengthening rouble to provide indirect support for Gold. For example, at USDRUB at 80, the bid price of a Gold ounce will be $1943. Thus, this level will become strong support. Bank of Russia says it fixed its price until the 30th of June, so until then, there will be a flexible (in USD terms) ceiling for the Gold price.

The FxPro Analyst Team