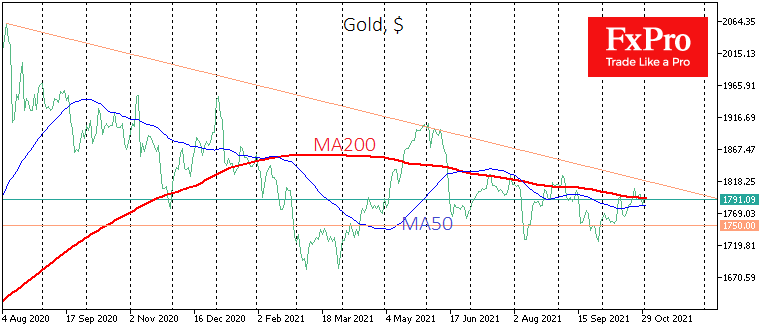

Gold added 1.5% during October, closing the month at $1783. In the last couple of weeks, it has been frequently above its 200-day moving average. So far, it is hard to talk about a bulls’ victory, but there are increasing signs that the peak of Gold’s pessimism is over, and by August 2022, we will see a new momentum of this metal to new all-time highs above $2600.

In the previous three months, we have seen a consistent reduction in volatility in Gold. But this lull looks more like a coiled-spring effect than a lack of interest or balance of forces.

Gold has been under systematic pressure, at one point walking on the edge of a bear market in August this year, about a year after reaching historic highs.

So far, there is little indication that interest rate rises in recent weeks have strengthened the Dollar.

On the contrary, there are growing fears that a sell-off in US and European bonds and a simultaneous rise in shares is the new trend, as investors are fleeing from fixed income securities that have turned profoundly negative.

And this is a favourable environment for Gold and cryptocurrencies. Bitcoin, Ether and Gold have strengthened simultaneously since late September. Cryptocurrencies have managed to hit new all-time highs. Gold lags behind them but correlates closely.

A consolidation during this week above the 200-day moving average (now near $1791) promises to be the first meaningful signal of a break in the long-term downtrend. Should it succeed, it would be much easier for the bulls to push Gold above the October highs area. A rate lock above $1830 could signal a break in the downtrend that has been ongoing since August 2020.

Globally, the entire momentum of Gold’s rise from the 2018 lows to the 2020 highs and the subsequent correction fits confidently into the Fibonacci retracement pattern, giving up 38.2% of the initial rally. Confirming signals for a bullish reversal open the prospect for Gold to rise 161.8% from the initial momentum into the $2600 area by July-August 2022.

The FxPro Analyst Team