Gold

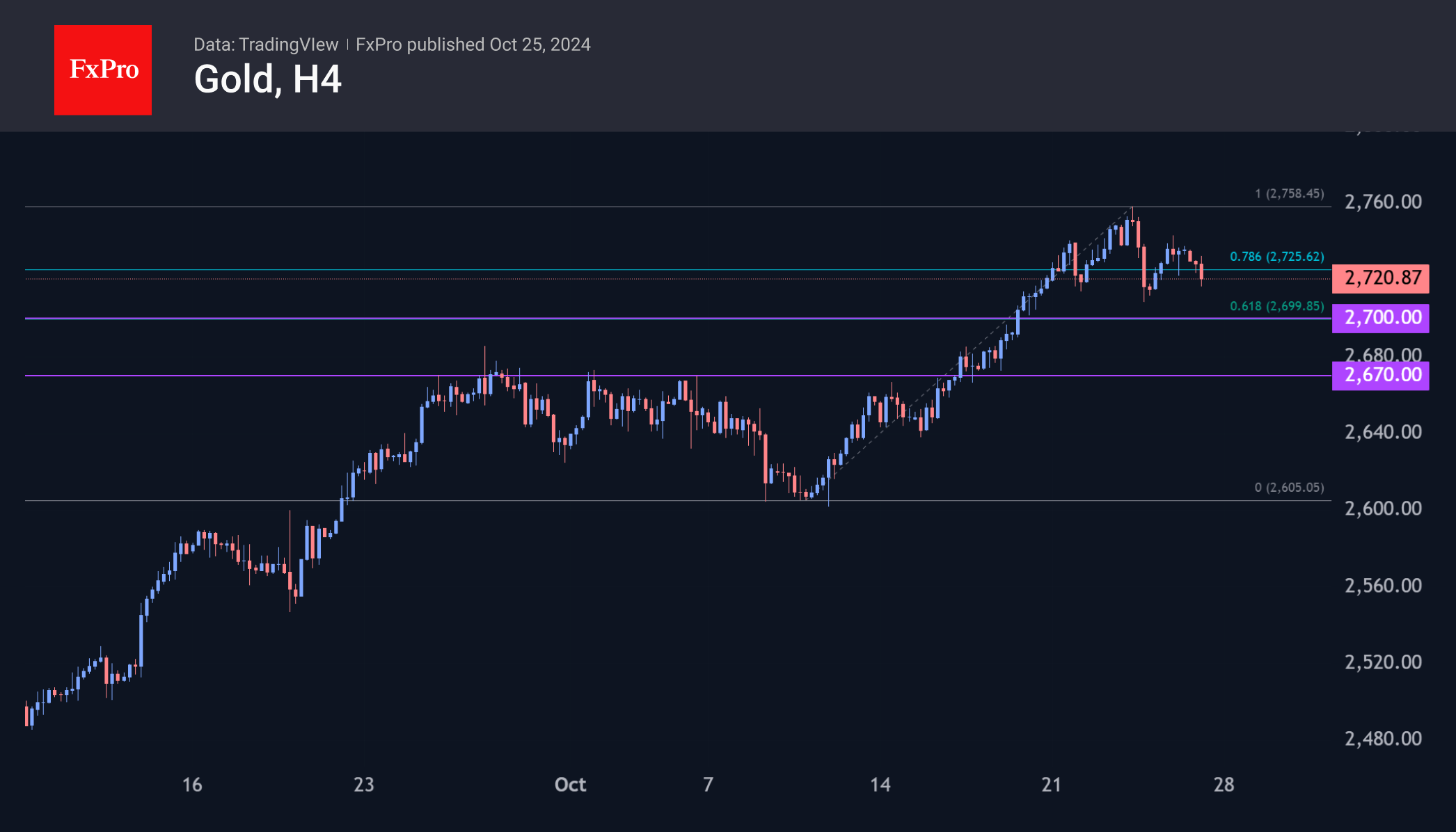

Gold continued to hit all-time highs in the first half of the week, peaking at $2,758 per troy ounce in the spot market. However, the price retreated by $50 on the same day and remained off the peak as caution grew towards the end of the week.

We wouldn’t be surprised to see a pullback to the $2,670-$2,700 range in the upcoming week. This won’t break the strong bullish trend. But a decisive break below will make us cautious in anticipation of a deeper pullback.

Palladium

Palladium was the star of the week among the metals, shining brighter than silver last week. The driver was the US call for the G7 to impose sanctions on Russian palladium exports, which companies control up to 40% of global supply.

Palladium is also considered a precious metal. It has been rallying since the beginning of October and had already made an important technical breakout in early September.

At the start of last month, palladium broke above its 50-day and then its 200-day moving averages within days of each other. In October, the approach to these levels provided support for buyers.

Since the start of the week, the price has gained around 9%, approaching levels last seen during the rally in December last year. At the time, the 200-day was acting as resistance, but it has now changed its status.

Given palladium’s low liquidity compared to gold and even silver, strong price movements cannot be ruled out. From current levels near $1170, the next and rather easy target to the upside is $1200, the peak at the end of last year.

A higher target is the $1500-1600 area, which has been a major turning point in the last five years. Even higher, at $1700, is the 200-week moving average, the crossing of which could signal excitement and possibly a repeat of the explosive rally from late 2018 to March 2020.

The FxPro Analyst Team